Broadening Breadth, Expanding Highs: Favor Mid-Cap Breakouts; Large Caps Lag as Volatility Compresses

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-10

Executive Summary Date: 2026-01-12

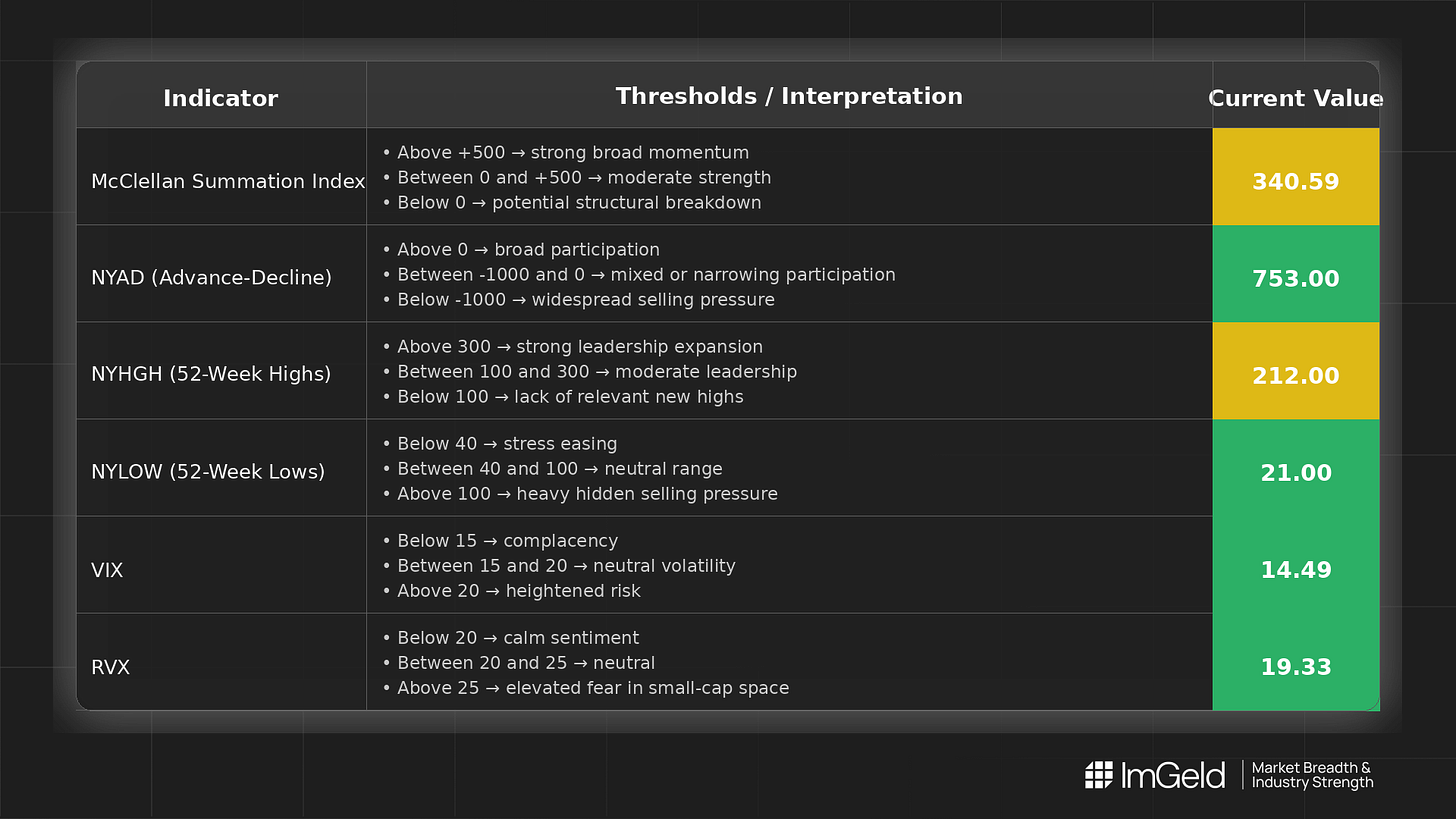

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) advanced from 287.82 to 340.59 and then held steady, while NYAD (Advance–Decline Line) flipped from a negative print to four consecutive positive readings. Volatility compressed as VIX (CBOE Volatility Index) slipped to 14.49 and RVX (Russell Volatility Index) to 19.33, both stabilizing at lows. New 52-week highs expanded and new lows contracted, supporting a tentative long bias. Tactically, long opportunities are emerging in mid-cap industries with expanding 52-week highs and persistent positive breadth thrusts; selectivity remains essential. Short setups remain more appropriate in large caps that are lagging breadth or failing to participate in breakouts; avoid long exposure in large caps.

Global Read

Participation is broadening, with leadership moving beyond prior narrow winners as new highs expand and declines shrink. Volatility is firmly compressing, which favors continuation patterns but can increase the risk of abrupt reversals. There is no adverse divergence: NYSI is rising and NYAD has been consistently positive. The five-day pattern signals early accumulation transitioning toward continuation; by the five-day consistency rule, breadth is firmly improving despite a two-day plateau in NYSI.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure is improving: a three-day rise followed by a two-day plateau at higher levels. By the consistency rule, this is firmly constructive.

NYAD (Advance–Decline Line) Daily participation strengthened meaningfully: one negative session followed by four consecutive positive prints. Firmly improving breadth.

NYHGH (New 52-Week Highs) Leadership expansion is evident, rising from 137 to 212 and holding. Firmly broadening leadership, a positive for mid-cap breakouts.

NYLOW (New 52-Week Lows) Downside pressure eased from 41 to 21 and stayed contained. Risk appetite remains supported.

Volatility Regime VIX and RVX declined and then stabilized at low levels, indicating compression. This backdrop supports breakout attempts in mid-cap groups, but requires disciplined risk controls given the potential for volatility reversion.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.