Broadening Breadth, Compressed Volatility: Tentative Long as Mid-Cap Leadership Emerges

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-12

Executive Summary As of 2026-01-12,

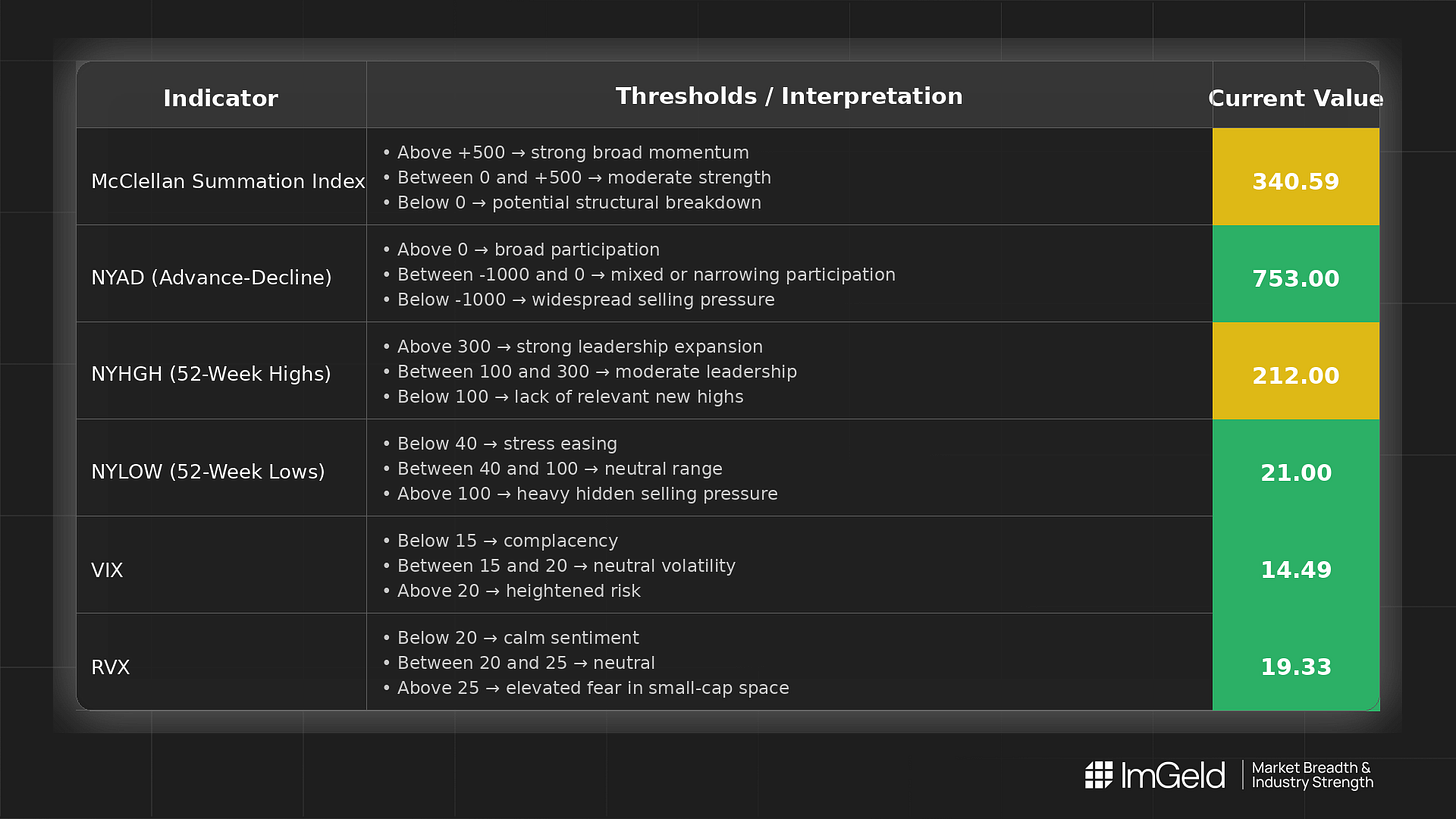

breadth improved over the past five sessions. NYSI (McClellan Summation Index) advanced for four sessions and then held steady, while NYAD (Advance–Decline Line) posted four positive days with one midweek setback. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) compressed back toward weekly lows, supporting constructive risk-taking with discipline. Tactical bias remains tentative long: prioritize mid-cap leadership in industries showing expanding new highs and shrinking new lows. Short opportunities are selective and primarily in large-cap laggards within deteriorating industries.

Global Read

Participation is broadening, evidenced by persistently positive NYAD, rising NYHGH, and falling NYLOW. Leadership is rotating modestly beyond prior narrow leadership, with new highs rebuilding rather than concentrating in a few symbols. Volatility is compressing, which favors follow-through but can amplify reversal risk on shocks. There is no material divergence between NYSI and NYAD; the isolated NYAD down day appears noise within an improving trend. The five-day pattern signals early accumulation, firmly, with a late-session plateau that argues for ongoing selectivity.

Indicator Breakdown

NYSI (McClellan Summation Index) Improving. The index rose from 259.16 to 340.59 and then plateaued, indicating constructive intermediate breadth with a maturing short-term impulse.

NYAD (Advance–Decline Line) Strengthening. Daily prints of +1050, -754, +1042, +753, +753 reflect broad participation with one interruption and a steady finish.

NYHGH (NYSE New 52-Week Highs) Leadership expansion. New highs recovered from 137 to 212, consistent with improving upside leadership across more constituents.

NYLOW (NYSE New 52-Week Lows) Downside pressure easing. New lows declined from 41 to 21, signaling improving risk appetite and fewer breakdowns.

Volatility Regime VIX and RVX ticked up midweek (15.45 and 20.33) before compressing to 14.49 and 19.33. This regime supports trend continuation and measured risk-taking, while warranting respect for potential volatility reversion.

Tactics

Longs: Focus on mid-cap names in industries demonstrating sustained breadth thrusts and rising new highs, including select software, semiconductor equipment, specialty industrials, and transportation services. Favor relative strength with staggered entries.

Shorts: Reserve for large caps in lagging or late-cycle defensive industries where breadth is deteriorating and rallies fade. Maintain tight risk due to low-volatility conditions.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.