Breadth Turns Up, Volatility Eases: Early Accumulation Favors Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-22

Executive Summary (2026-01-23)

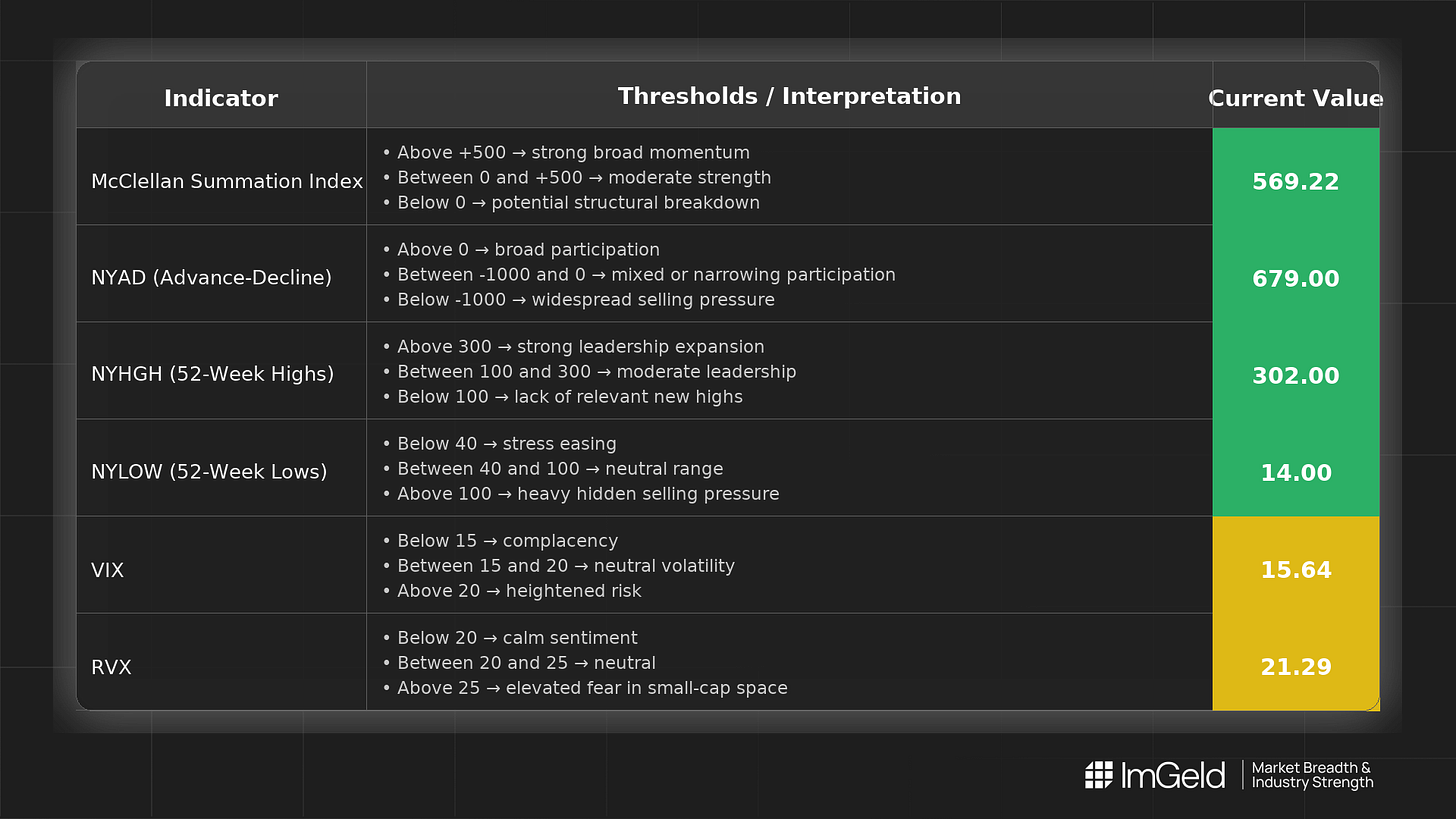

Breadth improved over the last three sessions, supporting a tentative long bias. NYSI (McClellan Summation Index) turned higher and held gains, NYAD (Advance–Decline Line) flipped from early-week negatives to sustained positives, and volatility normalized after a brief spike. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both compressed back toward recent lows.

Tactically, long opportunities are emerging in mid-cap industries showing expanding new highs with declining new lows and stable volatility. Short setups remain valid primarily in large caps where breadth lags and rallies fail near prior highs. Selectivity is still required given the early-stage nature of the improvement.

Global Read

Participation is broadening: NYHGH (New 52-Week Highs) advanced for three days while NYLOW (New 52-Week Lows) fell, and NYAD delivered two strong positive readings followed by stability. Leadership is modestly broadening rather than concentrating, with new highs expanding across multiple industries. Volatility is compressing after a single-day expansion, which favors continuation if breadth persists. NYSI’s upturn aligns with the late-week NYAD thrust, limiting divergence risk. By the five-day consistency rule, the last three sessions firmly indicate improving breadth, though the week’s earlier weakness means the overall signal remains early accumulation rather than full confirmation.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure improved from 516 to 569, then plateaued, suggesting constructive momentum with a pause rather than reversal. The higher high validates the late-week breadth thrust.

NYAD (Advance–Decline Line) Progression from -351 and -1560 to +1597 and +679, then steady, indicates breadth strengthening and better daily participation. The persistence of positives supports follow-through potential.

NYHGH (New 52-Week Highs) Rising from 110 to 302 across three sessions signals leadership expansion and healthier risk acceptance across mid-cap cohorts.

NYLOW (New 52-Week Lows) Declining from 61 to 14 shows downside pressure receding and improving internal resilience.

Volatility Regime VIX moved 15.86 → 20.09 → 16.90 → 15.64 and RVX 20.23 → 23.83 → 21.88 → 21.29, indicating a sharp, transient scare followed by compression. This backdrop supports selective risk-taking, particularly in mid-cap industries where breadth confirmation is strongest.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.