Breadth Stalls, Volatility Contained: Maintain Neutral Bias, Selective Longs, Cash Buffer

IMGELD Market Breadth Update: 2025-11-06 10:09:00

Executive Summary

Date: 2025-11-06

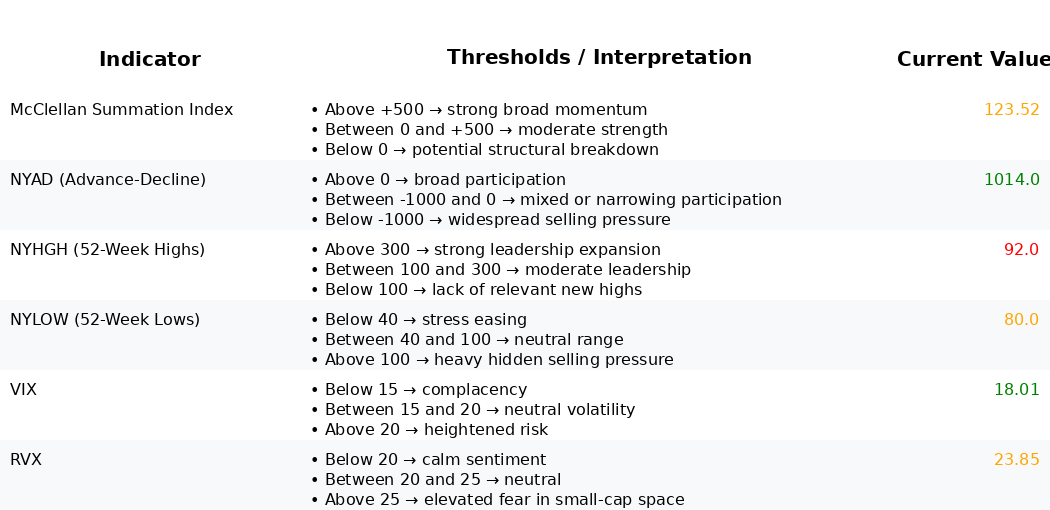

Over the past five sessions, the portfolio bias remains NEUTRAL with an indicative allocation of 65% Long, 0% Short, and 35% Cash. Breadth momentum is flat: the McClellan Summation Index (NYSI) holds positive at 123.52 without progression, and the NYSE Advance–Decline (NYAD) print is unchanged, signaling a plateau in participation. Volatility tone is neutral to slightly elevated (VIX 18.01, RVX 23.85), supportive of risk but not complacent. Tactically, maintain selective longs in names above long-term moving averages within high-scoring industries while preserving the cash buffer; defer broad short exposure unless McClellan Summation Index (NYSI) rolls over and new lows expand above risk thresholds.

Global Read

Structural breadth is steady but not expanding. McClellan Summation Index (NYSI) remains above zero at 123.52, which is constructive by threshold, yet two consecutive unchanged readings indicate stalled momentum. NYSE Advance–Decline (NYAD) is likewise static, reinforcing the view of a breadth plateau rather than broadening participation.

Leadership is mixed. NYHGH sits at 92, just below the 100–300 expansion band typically associated with strong leadership. NYLOW prints 80, above the healthy <40 zone but below the risk-off >100 threshold. This configuration signals lingering internal fragility without an outright deterioration, consistent with a market that is consolidating rather than trending.

Volatility remains in neutral corridors. VIX at 18.01 and RVX at 23.85 imply manageable tail risk; the RVX–VIX spread reflects a normal small-cap risk premium. Vol conditions are permissive for selective risk-taking but argue for disciplined sizing given the absence of breadth acceleration.

3–8 week outlook: neutral-to-cautiously constructive, contingent on renewed breadth thrust. Confirmation would come from a rising McClellan Summation Index (NYSI) that stays above zero, NYHGH expanding sustainably above 150 with NYLOW trending <40, and VIX/RVX remaining contained or easing. Invalidation would be a decisive McClellan Summation Index (NYSI) rollover toward/below zero, NYLOW >100 and rising, and a volatility breakout (VIX >22, RVX >28), which would warrant cutting cyclically sensitive longs and increasing defensive posture.

Tactical focus: concentrate long exposure in sectors with strong ImGeld Industry Scores and stocks holding above their 200/150-day SMAs; avoid chasing breakouts until new highs broaden. Keep shorts tactical and event-driven only; consider scaling them only on breadth deterioration and a volatility upshift.

Market Breadth Summary (Last Five Sessions):

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.