Breadth Stalls, Volatility Compresses: Lean Into Selective Mid-Caps, Fade Crowded Growth

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-17

Executive Summary

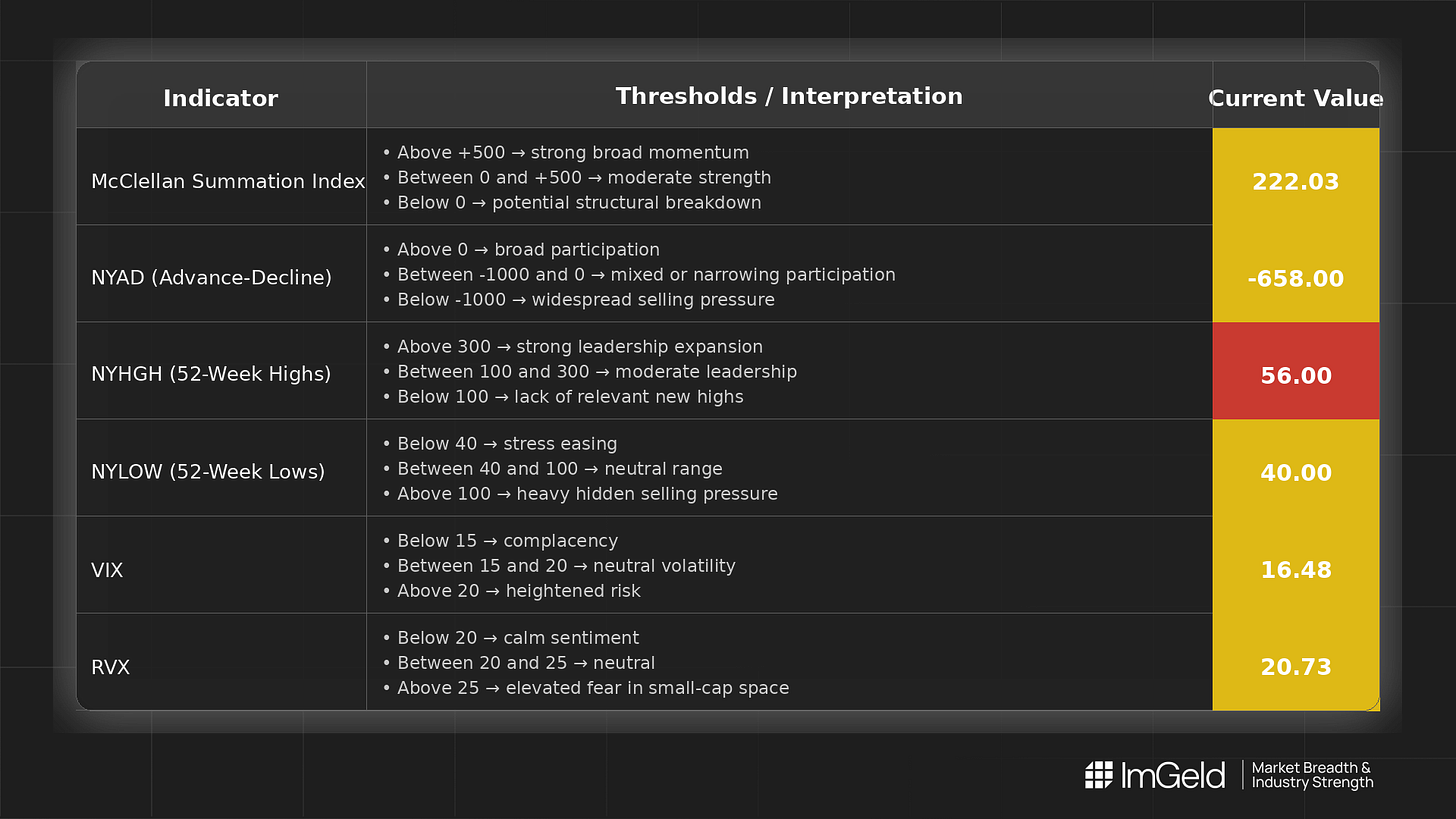

Bias remains neutral with elevated selectivity. Over the last few sessions, breadth stalled while participation weakened. NYSI (McClellan Summation Index) is flat at 222.03, indicating a plateau above zero, while NYAD (Advance–Decline Line) remains negative at -658, signalling persistent net decliners. NYHGH (New 52-Week Highs) at 56 and NYLOW (New 52-Week Lows) at 40 are steady, showing modest leadership without expansion. VIX (CBOE Volatility Index) at 16.48 and RVX (Russell Volatility Index) at 20.73 are unchanged, reflecting volatility compression.

Tactically: emphasise selective mid-cap longs in resilient, cash-generative industries where new highs persist, and pullbacks are shallow. Maintain shorts in large-cap, crowding-prone growth complexes where breadth is narrowing, and leadership is concentrated. Selectivity is high.

Global Read

Participation is narrowing, and leadership is becoming more concentrated. Volatility is compressing with stable VIX and RVX prints. A divergence is present: NYSI is positive but flat, while NYAD is negative, indicating underlying participation is not confirming the higher-level breadth structure. With two consecutive days of consistent readings, signals firmly point to stalling breadth rather than broadening. The five-day pattern skews toward early exhaustion risk, pending confirmation from a rebound in NYAD or a renewed expansion in NYHGH.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is plateauing. Above zero supports a residual intermediate uptrend, but the lack of upward progress flags fading momentum.

2. NYAD (Advance–Decline Line)

Consecutive negative readings indicate weakening daily participation. Buyers are selective, and advances are not diffusing across the list.

3. NYHGH (New 52-Week Highs)

Stable in the mid double-digits, suggesting leadership exists but is not broadening. Leadership remains confined to a smaller cohort.

4. NYLOW (New 52-Week Lows)

Contained at 40, implying downside pressure is manageable. Risk appetite is cautious, not capitulatory.

5. Volatility Regime

VIX at 16.48 and RVX at 20.73 are static, indicating compressed volatility and a carry-friendly backdrop. With breadth soft, sudden shocks are possible; favour tactical mean-reversion while sizing for event risk.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.