Breadth Stalls, Leadership Narrows: Muted Volatility Favors Mid-Cap Longs, Fade Mega-Cap Tech

MGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-18

Executive Summary

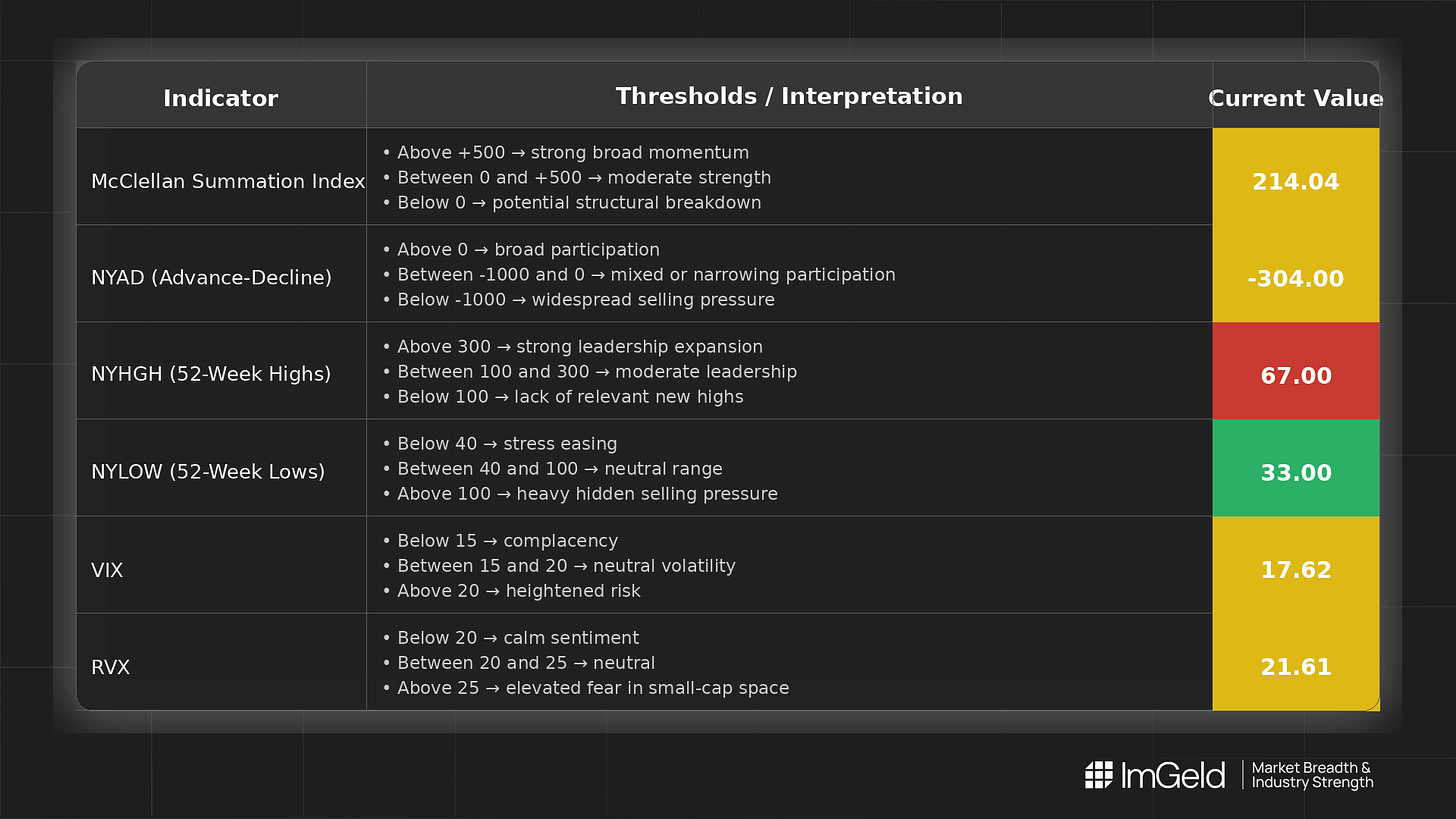

As of 2025-12-18, breadth is stalling. NYSI (McClellan Summation Index) is unchanged at 214.04, signaling a plateau after prior improvement. NYAD (Advance–Decline Line) remains negative at -304, indicating weak day-to-day participation despite modest leadership, with NYHGH at 67 and NYLOW at 33. Volatility tone is steady: VIX (CBOE Volatility Index) at 17.62 and RVX (Russell Volatility Index) at 21.61, implying contained risk premia and a range-biased tape.

Tactically, selective long opportunities may be emerging in mid-cap industries showing relative strength and improving new-highs breadth (homebuilding, building products, industrial machinery, specialty insurance). Short setups remain valid in large-cap dominated areas where leadership is tiring and rallies are being sold (internet & interactive media, mega-cap chip-heavy industries). Selectivity remains high.

Global Read

Breadth participation is narrowing: daily AD remains negative while new highs exceed new lows, pointing to concentrated leadership rather than broad expansion. Leadership is becoming more concentrated, not rotating broadly. Volatility is stable and muted, favoring mean reversion over directional breakouts. A divergence persists as NYSI holds elevated while NYAD stays negative, signaling trend persistence but weak underlying participation. By the five-day consistency rule, the latest pattern is firmly plateauing, consistent with early but unconfirmed accumulation and a higher bar for follow-through.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is plateauing over recent sessions at 214.04. The prior advance is intact, but momentum has stalled, increasing the risk of chop if participation does not improve.

2. NYAD (Advance–Decline Line)

Daily participation is weak with two consecutive negative prints at -304. Breadth is not strengthening; buyers are selective and concentrated.

3. NYHGH (New 52-Week Highs)

Stable at 67, indicating modest leadership expansion. The count is constructive but not broad enough to confirm a sustained advance.

4. NYLOW (New 52-Week Lows)

Stable at 33, signaling contained downside pressure and steady risk appetite. The lows are not expanding, which supports a neutral-to-cautious risk stance.

5. Volatility Regime

VIX at 17.62 and RVX at 21.61 are unchanged, reflecting a contained volatility backdrop. This favors tactical singles over home runs, with a bias to pairs and quick risk management.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.