Breadth rebounds then wobbles: NYSI nears zero, NYAD reverses; selective mid-cap longs emerge

IMGELD Market Breadth Update Based On Last 5 days of Data Time Stamp : 2025-12-02 10:31:09

Executive Summary

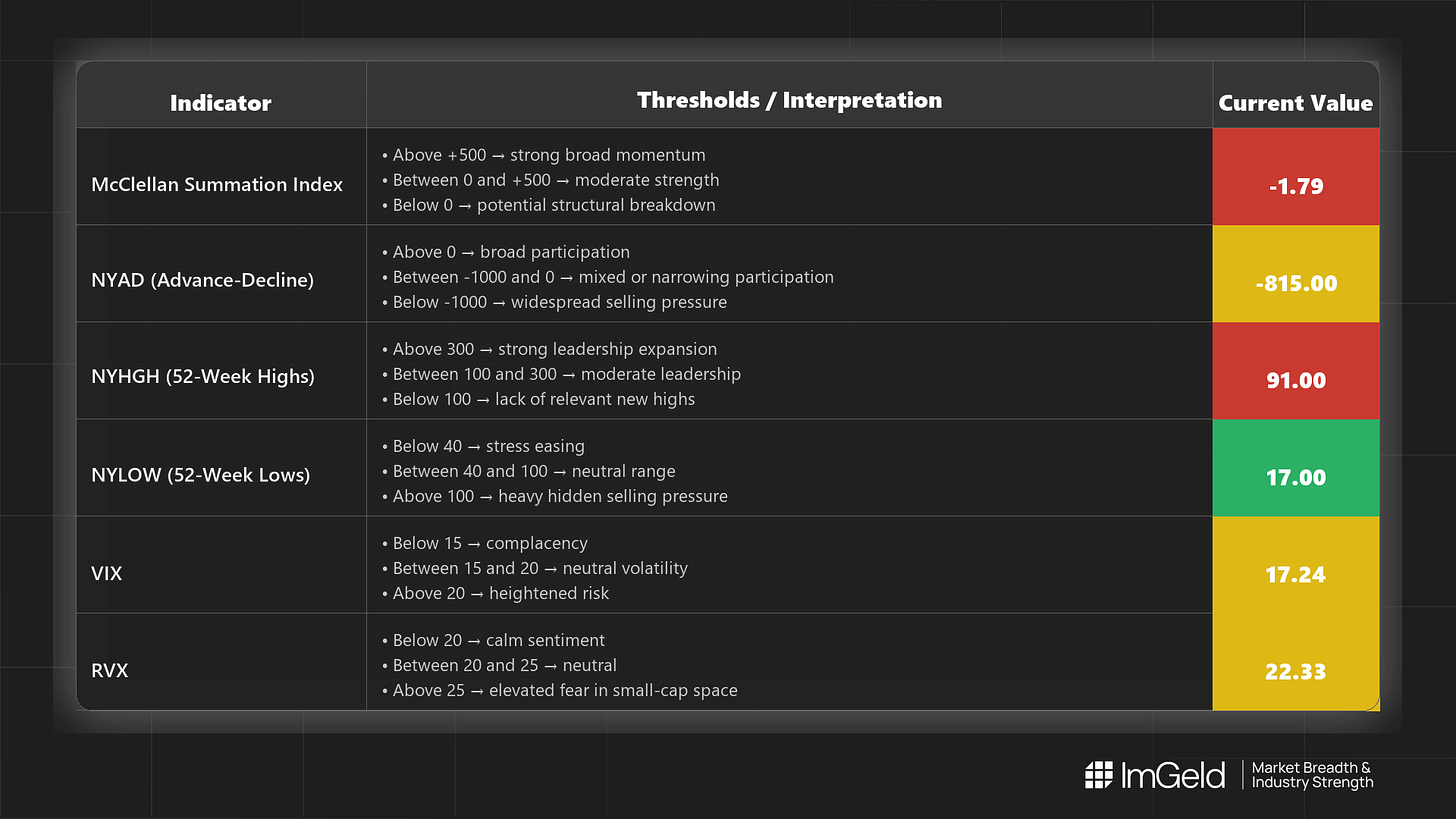

Breadth improved sharply through four sessions, then weakened on the final day. NYSI (McClellan Summation Index) climbed from -128.47 to -1.79, signaling a strong short-term repair toward the zero line. NYAD (Advance–Decline Line) posted four consecutive positive prints before reversing to -818 today, introducing caution. Volatility compressed then upticked: VIX (CBOE Volatility Index) fell to 16.35 and rebounded to 17.24; RVX (Russell Volatility Index) mirrored this pattern. Early long opportunities may be emerging in selective mid-cap names within industries that continue to show steady breadth and stable volatility. Short opportunities remain valid in crowded large caps where participation is faltering and volatility is re-expanding. Selectivity is high.

Global Read

Participation broadened over the first four sessions and narrowed meaningfully today. Leadership is not convincingly expanding, with new highs fading and new lows ticking up, implying concentration rather than dispersion. Volatility’s modest re-expansion suggests risk appetite has cooled from last week’s calm. A mild divergence is present: NYSI continues higher toward zero while NYAD rolled over today, which could stall breadth improvement if weakness persists. The five-day pattern signals early accumulation that now remains tentative. By the five-day consistency rule, mixed signals within the window means the bias remains tentative.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

The structure is improving. A swift rise from deeply negative to near-flat indicates a constructive impulse, but confirmation requires a sustained move above zero.

2. NYAD (Advance–Decline Line)

Participation strengthened for four sessions (1663, 1213, 1181, 867) before weakening to -818. This reversal tempers the prior improvement and raises the bar for upside follow-through.

3. NYHGH (New 52-Week Highs)

Leadership expansion softened from a mid-week peak. Prints eased from 125 to 90, signaling fewer leaders pressing higher.

4. NYLOW (New 52-Week Lows)

Downside pressure compressed to 4 then rose to 15. The uptick suggests a modest rebuild in risk aversion.

5. Volatility Regime

VIX moved 18.56 to 16.35 to 17.24; RVX moved 23.36 to 21.48 to 22.33. Compression followed by re-expansion argues for disciplined entries, respecting that downside tails can reassert quickly.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.