Breadth Narrows, Volatility Rises: Late-Cycle Distribution Favors Selective Mid-Caps, Large-Cap Shorts

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-02

Executive Summary

Breadth softened over the last five sessions. NYSI (McClellan Summation Index) rose early then rolled over, ending lower versus 12/26. NYAD (Advance–Decline Line) flipped negative for three consecutive days, culminating in a sharp -1,339. Volatility firmed: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both drifted higher into year-end.

Bias remains tentative long, but with high selectivity. Long opportunities may be emerging only in resilient mid-cap industries showing stable leadership and contained new lows. Short setups remain valid in crowded large-cap leadership where breadth is thinning and volatility is expanding.

Global Read

Participation is narrowing, with leadership becoming more concentrated as NYHGH declines and NYLOW rises. Volatility is modestly expanding. A negative divergence emerged as NYSI, while still positive, rolled over while NYAD deteriorated sharply. By the five-day consistency rule: NYAD weakness (3 days) = firmly weakening; NYSI rollover (3 sessions) = firmly weakening; VIX/RVX rise (4 sessions) = firmly expanding. The pattern indicates late-cycle exhaustion of the prior advance and early distribution rather than fresh accumulation.

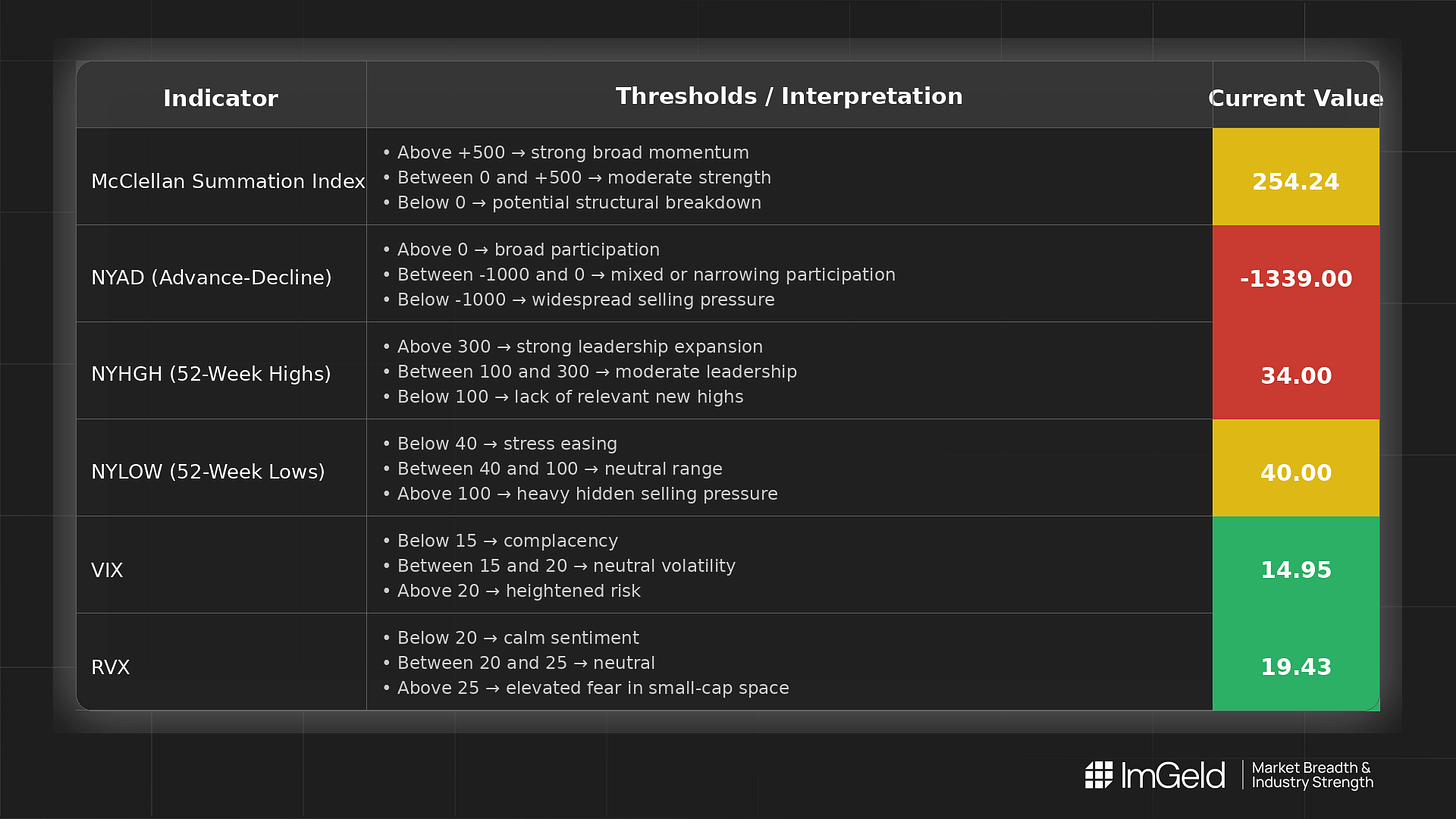

Indicator Breakdown

NYSI (McClellan Summation Index) Structure: Improving into 12/29 (284.26) followed by a three-session decline and a flat close at 254.24. Net effect: weakening momentum and loss of thrust.

NYAD (Advance–Decline Line) Daily participation weakened: +987 (12/26), then -686, -129, and a decisive -1,339 (12/31). Firmly negative breadth into the close suggests sellers gained control beneath the index surface.

NYHGH (New 52-Week Highs) Leadership contraction: 91 → 41 → 48 → 34 → 34. Fewer issues are sustaining breakouts, pointing to reduced leadership breadth.

NYLOW (New 52-Week Lows) Downside pressure building: 20 → 27 → 22 → 40 → 40. Rising new lows warn of increasing fragility and elevate the bar for longs.

Volatility Regime VIX: 13.47 → 14.95; RVX: 18.13 → 19.43. Both are trending higher from subdued levels, signalling mild regime expansion. Implication: tighter risk management for longs and improving asymmetry for tactical shorts, especially in over-owned large caps.

Tactical Take

Long side: limit to mid-cap industries with demonstrated relative strength, improving internal breadth, and stable earnings revision trends. Avoid chasing breakouts where NYHGH is not confirming.

Short side: continue to target fatigued, overextended large-cap leadership and cyclically sensitive industries showing rising NYLOW participation and negative breadth follow-through.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.