Breadth Narrows, Volatility Compresses: Target Mid-Cap Leaders, Short Overextended Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-15

Executive Summary

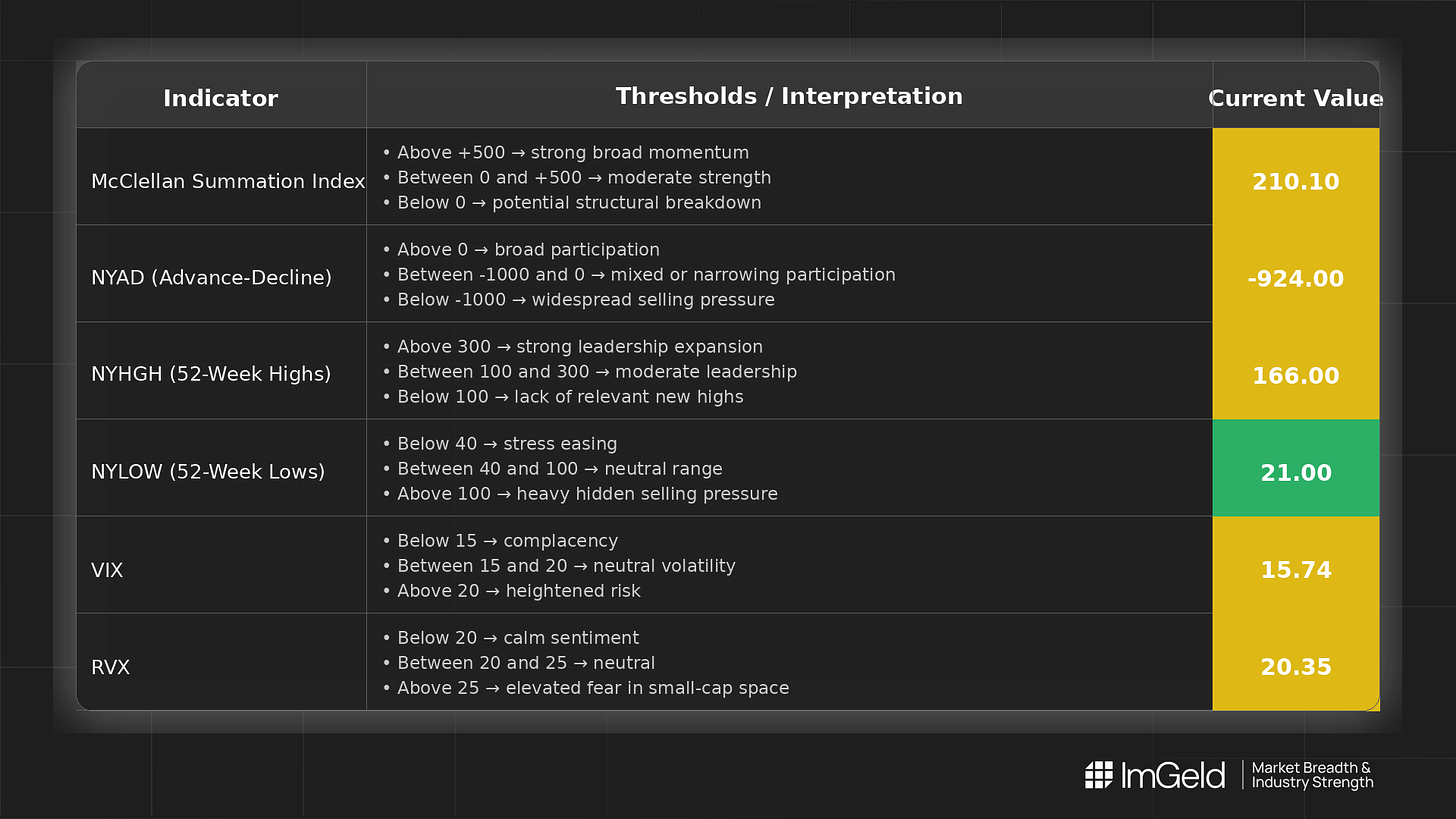

Breadth over the past five sessions is stable to slightly narrowing. NYSI (McClellan Summation Index) is holding a positive plateau near recent highs, while NYAD (Advance-Decline Line) remains negative, flagging uneven participation. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) are steady at low-to-moderate levels, consistent with volatility compression.

Tactically, maintain a selective, tentative long bias in mid-cap industries where new highs are expanding and downside pressure is muted. Short opportunities remain valid in overextended large caps showing lagging breadth and waning momentum. Selectivity is critical given the divergence between cumulative breadth and daily participation.

Global Read

Participation is not broadening; it is narrowing modestly as NYAD stays negative despite elevated new highs, implying rally leadership is becoming more concentrated. Volatility is compressing, with both VIX and RVX flat, supporting range-trading behavior and favoring rotation. The divergence between a positive, flat NYSI and a negative NYAD points to underlying fragility beneath an intact intermediate trend. On the five-day consistency rule, signals remain mixed, indicating a continuation phase with mounting risk of exhaustion if participation does not improve.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is plateauing at a positive level, suggesting the intermediate uptrend is intact but losing incremental thrust. No evidence of a rollover yet, but momentum is not expanding.

2. NYAD (Advance-Decline Line)

Daily participation is weak, with persistent net decliners. This undermines the sustainability of upside unless breadth re-engages.

3. NYHGH (New 52-Week Highs)

Leadership expansion persists with elevated new highs, indicating continued strength among winners, albeit increasingly concentrated.

4. NYLOW (New 52-Week Lows)

Lows remain subdued, signaling limited downside pressure and a constructive risk appetite backdrop, despite weak daily breadth.

5. Volatility Regime

VIX around mid-teens and RVX near 20 are both unchanged, reflecting compressed volatility. This supports tactical mean reversion and favors selective positioning rather than broad beta exposure. Complacency risk is rising if breadth does not broaden.

Tactical Implications

- Long: Focus on mid-cap industries exhibiting persistent new highs and stable lows, such as specialty chemicals, industrial machinery, software infrastructure, and medical technology, where relative strength is building with controlled volatility.

- Short: Large-cap setups remain appropriate in overextended industry bellwethers within interactive media and services, mega-cap semiconductors, and integrated energy where breadth lags and momentum stalls.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.