Breadth Narrows, NYAD Flips Negative: Favor Tentative Shorts Amid Rising Volatility

IMGELD Market Breadth Update: 2025-11-17 16:40:50

ImGeld Market Breadth Update, 2025-11-14

Executive Summary

Bias: TENTATIVE SHORT.

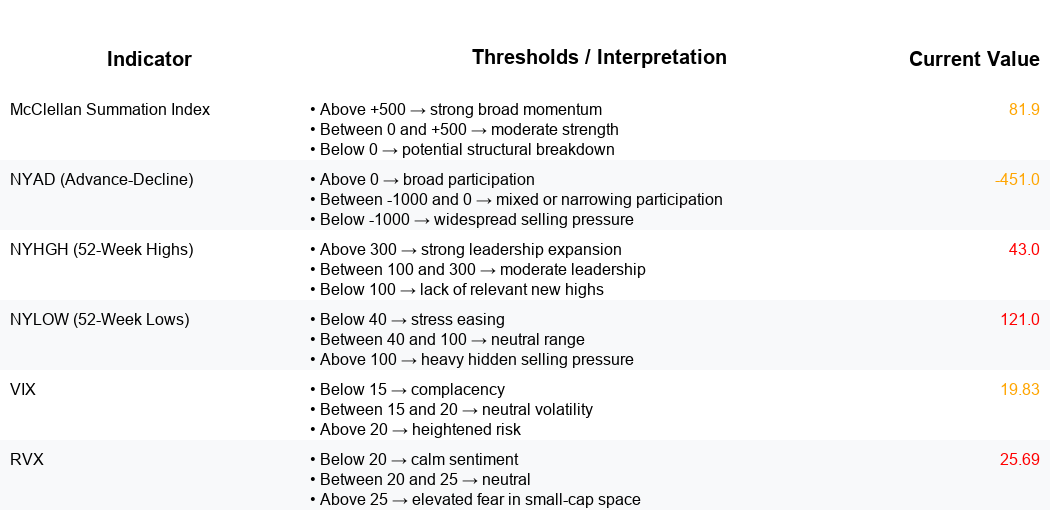

NYSI (McClellan Summation Index) rose into midweek, then rolled over, signaling waning thrust. NYAD (Advance–Decline Line) flipped from modestly positive to decisively negative, confirming deterioration in participation. Volatility tone turned risk-off as VIX (CBOE Volatility Index) rose toward 20 and RVX (Russell Volatility Index) toward 26.

Long opportunities are limited and highly selective in resilient mid-cap industries only. Short opportunities remain valid, including in large caps where leadership is weakening. Selectivity should be high.

Global Read

Breadth narrowed into week end. Early week gains were carried by fewer names and leadership became more concentrated, then faded as new lows expanded and new highs collapsed. Volatility expanded rather than compressed, favoring defense and shorter holding periods. A brief NYSI upturn conflicted with a quickly fading NYAD, then both deteriorated. The five-day pattern signals a failed accumulation attempt and emerging distribution. By the five-day consistency rule, signals are mixed across the window, so the stance remains tentative rather than firm.

Market Breadth Summary (Last Five Sessions)

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Improved Monday to Wednesday (79.22 to 117.48), then declined Thursday and Friday to 81.88. Structure shifted from improving to weakening, indicating loss of breadth momentum.

2. NYAD (Advance–Decline Line)

Daily participation weakened progressively. After +1012, +759, and a very soft +62, breadth turned negative with -1589 and -451, pointing to distribution into weakness.

3. NYHGH (New 52-Week Highs)

Leadership expansion stalled. Highs slipped from 159 midweek to 43 by Friday, indicating fewer sustainable breakouts and thinning leadership.

4. NYLOW (New 52-Week Lows)

Downside pressure increased. Lows rose from 41 midweek to 121 on Friday, reflecting deteriorating risk appetite and broadening weakness.

5. Volatility Regime

VIX rose from 17.3 to about 20 and RVX from 23.6 to about 26, an expansionary regime. Elevated and rising volatility favors risk management, quicker trade cycles, and gives an edge to downside momentum over breakout attempts.

Tactical Allocation Guidance

Maintain a TENTATIVE SHORT bias. The rollover in NYSI, negative NYAD inflection, collapsing NYHGH, rising NYLOW, and expanding VIX and RVX argue for caution and a tilt to downside momentum.

- Higher probability long setups: only in selective mid-cap industries demonstrating relative strength and stable new-highs to lows profiles, such as specialty chemicals with pricing resilience, defense-related suppliers, and niche application software with recurring revenue. Avoid large caps on the long side.

- Valid short setups: large-cap semiconductors, large-cap internet and direct marketing retail, and other mega-cap growth industries where breadth has deteriorated and leaders are failing recent breakouts.

Selectivity should be high. Momentum continuation to the downside has the advantage over mean reversion while volatility remains unstable.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.