Breadth Narrows Into Year-End; Volatility Ticks Up: Favor Selective Mid-Caps, Underweight Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-30

Executive Summary (as of 2025-12-31)

Breadth is drifting into a mixed, more selective tape. NYSI (McClellan Summation Index) advanced early in the week then flattened, while NYAD (Advance-Decline Line) flipped negative for three consecutive sessions, signaling narrowing participation. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both climbed modestly, pointing to a mild expansion in volatility.

Tactically, selective mid-cap long setups may emerge where new highs are holding and lows remain subdued. Short setups remain valid in large caps showing deteriorating breadth and in mid-cap laggards where participation is weakening. Selectivity is high.

Global Read

Participation is narrowing as three consecutive negative NYAD prints offset the earlier breadth thrust. Leadership is becoming more concentrated, with new highs compressing and only a small late-week stabilization. Volatility is modestly expanding, reducing risk-adjusted carry and raising the bar for breakouts. A divergence is present: NYSI remains elevated after its early-week rise while NYAD weakens, suggesting fading momentum beneath the surface. By the five-day consistency rule, signals remain mixed rather than firmly trending, indicating a late-December accumulation attempt that is tentative and at risk of stalling without a swift pickup in advances.

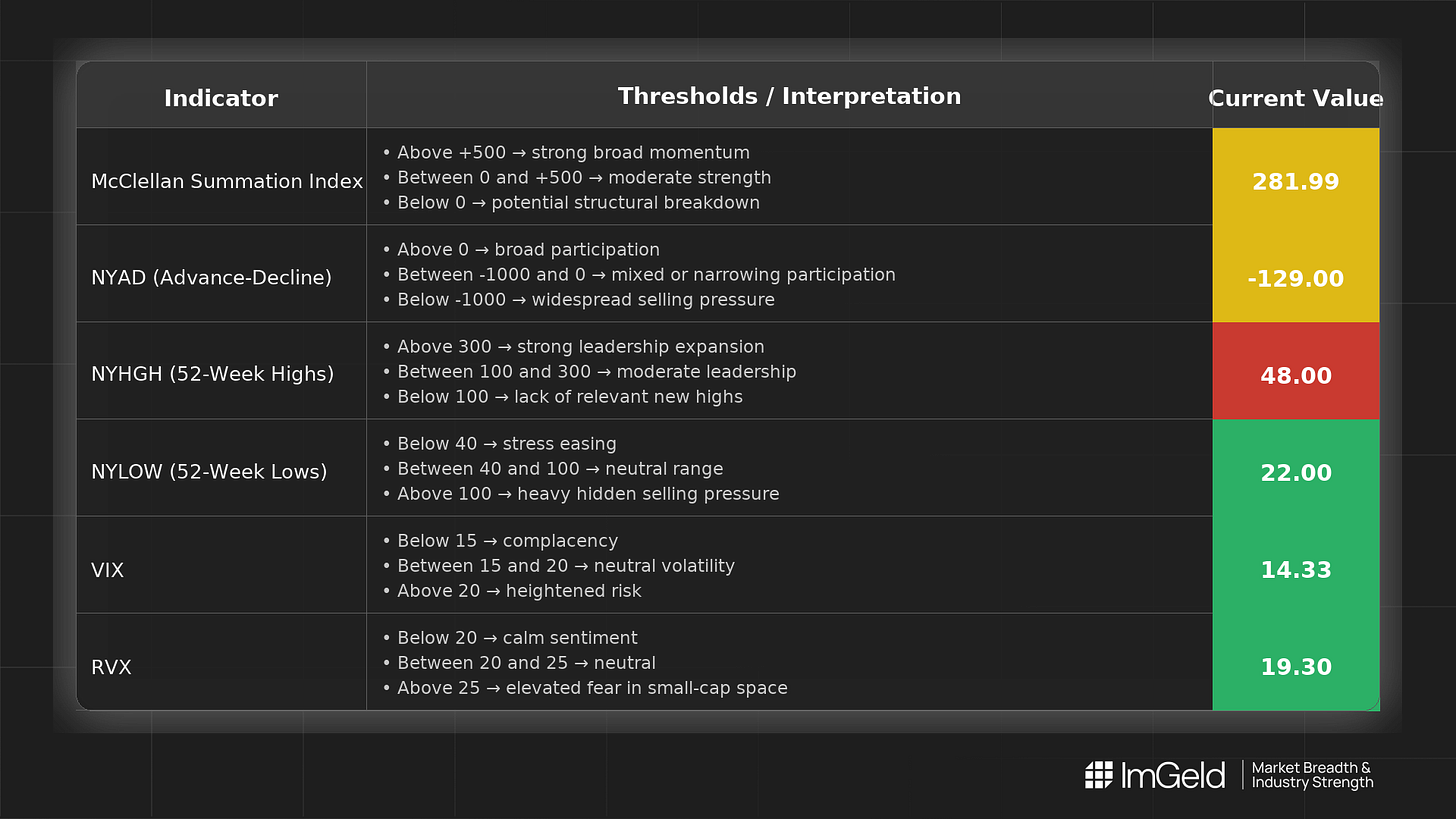

Indicator Breakdown

NYSI (McClellan Summation Index) Structure improved from 264.16 to 284.26, then eased to 281.99 and stalled. The pattern is improving then plateauing, net constructive but tentative given the loss of follow-through in the last two sessions.

NYAD (Advance-Decline Line) After two strong positive days (+987), participation turned negative (-686, then -129, -129). Daily breadth weakened across the last three sessions, consistent with distribution pressure and narrower leadership.

NYHGH (New 52-Week Highs) Fell from 91 to 41, then stabilized at 48. Leadership expansion contracted materially, with only a modest late-week rebound. This points to fewer leaders carrying returns.

NYLOW (New 52-Week Lows) Rose from 20 to 27, then eased to 22 and held. Downside pressure ticked up and remains marginally elevated, implying softer risk appetite than earlier in the period.

Volatility Regime VIX rose from 13.47 to 14.33 and RVX from 18.13 to 19.30, marking a steady three-session climb. This moderate expansion argues for tighter risk controls, patience on breakouts, and preference for idiosyncratic mid-cap long setups while fading strength in deteriorating large caps remains viable.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.