Breadth Mixed, Volatility Calm: Mid-Cap Breakouts Gain While Large-Cap Leaders Lose Steam

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-05

Executive Summary

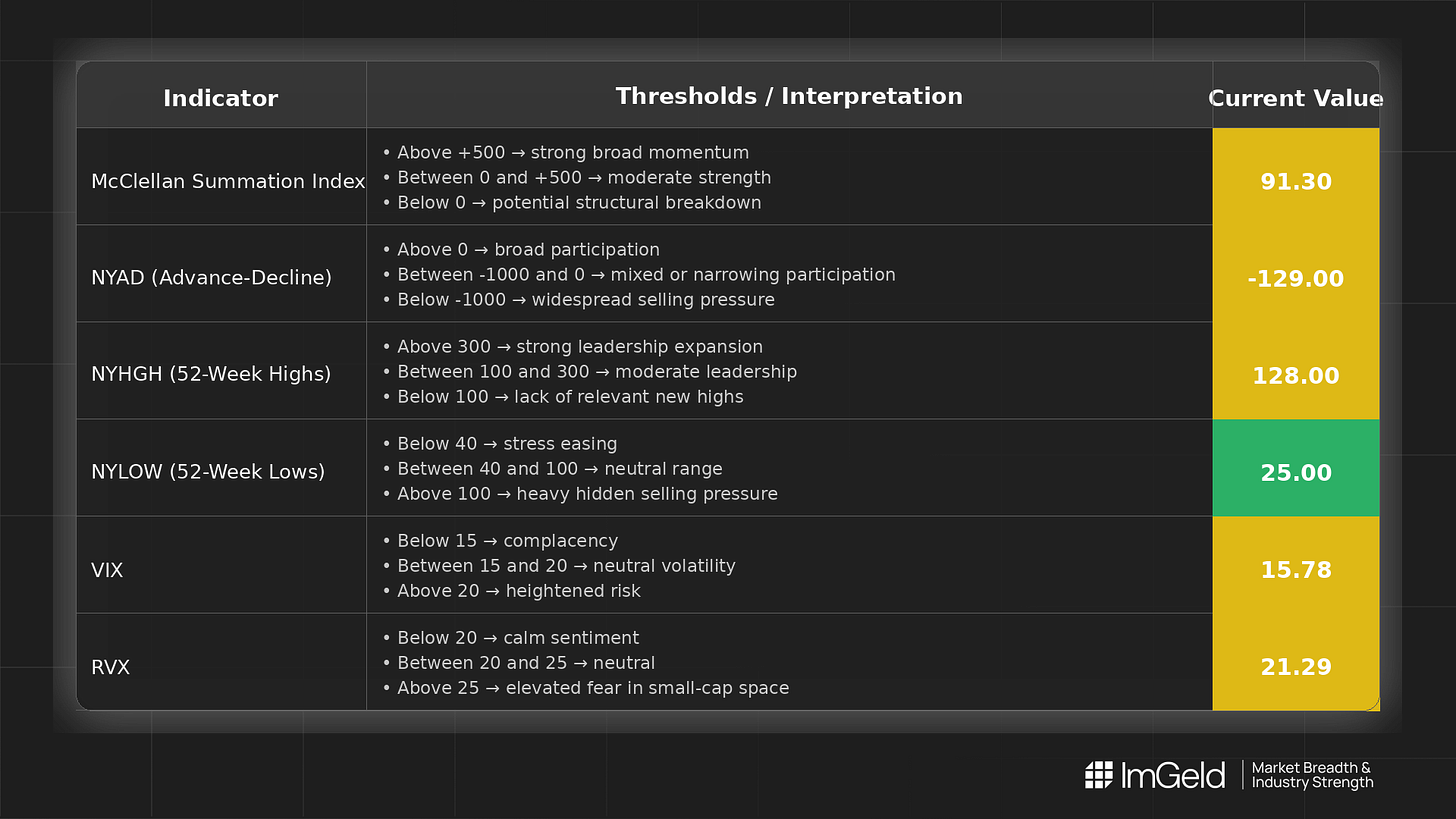

Breadth is mixed over the recent window, with an isolated positive tone from NYSI (McClellan Summation Index) contrasted by weak daily participation in NYAD (Advance-Decline Line). NYHGH (New 52-Week Highs) materially outpaces NYLOW (New 52-Week Lows), while VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) sit in benign ranges. Given the one-day snapshot, signals are tentative under the five-day consistency rule.

Tactically, long opportunities may be emerging in select mid-cap industries showing expanding new highs and resilient breadth. Short setups remain valid in large caps where leadership is narrowing and momentum is rolling, particularly in overcrowded, index-heavy industries. Selectivity remains high.

Global Read

Participation shows tentative broadening as new highs rise and lows stay contained, but the negative NYAD flags a soft daily tape. Leadership appears in the early stages of rotating toward more diverse mid-cap industries, though concentration risk in large caps persists. Volatility is stable to mildly compressed, supporting a measured risk-on stance with tight risk controls. A mild divergence is present, with NYSI positive while NYAD is negative, implying a pullback within a constructive intermediate setup. With only one consistent day, the pattern is Tentative rather than Firmly trending; it leans toward early accumulation but requires confirmation.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is tentatively improving, remaining positive and supportive of intermediate breadth. Confirmation over additional sessions is needed.

2. NYAD (Advance-Decline Line)

Daily participation weakened, indicating narrow advances and rotational churn. Until this reverses, expect choppy follow-through.

3. NYHGH (New 52-Week Highs)

Leadership expansion is evident with elevated new highs, hinting at ongoing breakouts in select mid-cap industries.

4. NYLOW (New 52-Week Lows)

Downside pressure remains contained, consistent with risk appetite stabilizing above recent stress points.

5. Volatility Regime

VIX at 15.78 and RVX at 21.29 suggest a benign, stable volatility backdrop. With no clear five-day trend provided, treat the regime as steady to slightly compressing, which favors disciplined trend and breakout tactics but leaves markets vulnerable to headline shocks.

Tactical Implications

- Long: Focus on mid-cap industries where leadership is broadening and new highs are clustering, such as industrial machinery, specialty chemicals, software infrastructure, and select capital goods, prioritizing names with improving breadth and positive earnings revision momentum.

- Short: Target large caps in industries showing deteriorating participation and momentum fatigue, including overowned consumer internet, mega-cap software, and defensive staples-heavy groups that are lagging breadth. Maintain high selectivity and clear risk thresholds.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.”