Breadth Improves, Volatility Eases: Prioritize Mid-Cap Longs; Selective Large-Cap Shorts

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-15

Executive Summary (2026-01-16)

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) advanced four days and held gains; NYAD (Advance–Decline Line) produced three strong expansion days into a weekly high. Volatility tone: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) rose midweek then eased, leaving a constructive but not complacent backdrop. Tactically: prioritize selective long setups in mid-cap industries where new highs are expanding and participation is improving; large-cap shorts remain valid only where relative breadth is deteriorating despite the tape.

Global Read

Participation is firmly broadening: NYSI climbed from 340.6 to 487.9 and NYAD finished the week strong, while NYHGH advanced and NYLOW stayed muted. Leadership is rotating toward issues making new highs rather than concentrating in a narrow cohort. Volatility briefly expanded, then stabilized, suggesting a supportive risk environment without excessive leverage. NYSI and NYAD show no material negative divergence; NYSI’s late-week plateau reflects consolidation, not reversal. The five-day pattern signals early accumulation rather than exhaustion per the consistency rule.

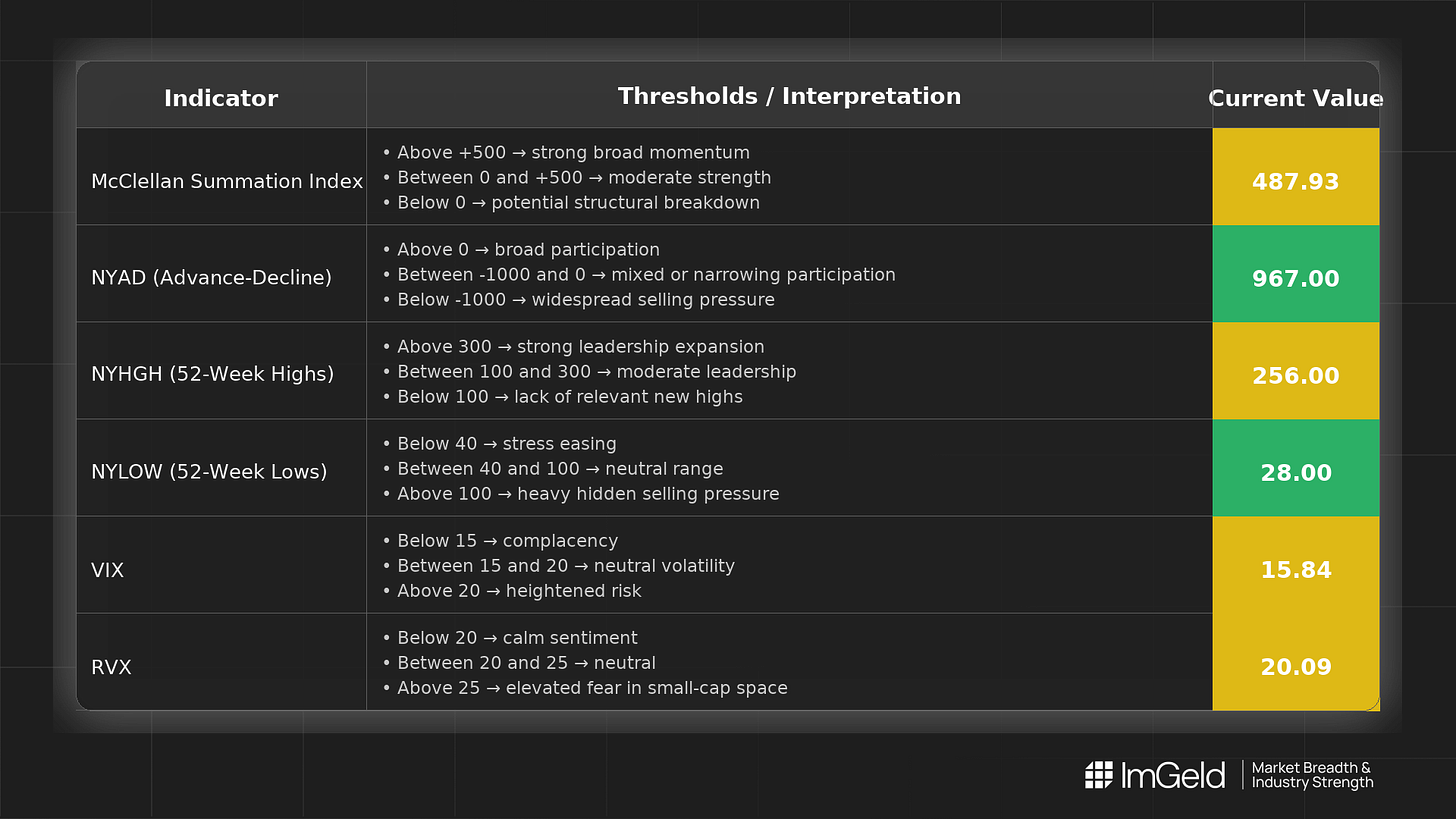

Indicator Breakdown

NYSI (McClellan Summation Index) Structure is improving: four consecutive advances (340.6 to 487.9) followed by a flat session, indicating momentum that is decelerating into a pause rather than rolling over.

NYAD (Advance–Decline Line) Breadth strengthened: after a softer 189 reading on 01-13, participation surged with 804 and 967 on 01-14 to 01-16, sustaining elevated levels into the close of the week.

NYHGH (New 52-Week Highs) Leadership expansion is evident: highs progressed from 212 to 256, with the final two sessions steady at the weekly peak, confirming follow-through.

NYLOW (New 52-Week Lows) Downside pressure remains subdued: lows hovered in the high 20s with no acceleration, consistent with improving risk appetite.

Volatility Regime VIX rose from 14.5 to 16.8 midweek, then eased to 15.8; RVX followed a similar path (19.3 to 20.6, then 20.1). This pattern favors disciplined risk-taking, with room for trend extension but warrants respect for intermittent shakeouts.

Tactical Implications

Longs: Focus on mid-cap industries showing verified breadth thrusts and leadership expansion (e.g., industrial technology, building products, aerospace suppliers, regional banks). Emphasize breakouts backed by rising NYHGH and solid A–D.

Shorts: Reserve for large caps displaying persistent relative underperformance and weak breadth despite the index tailwind (e.g., defensive consumer giants, mega-cap communication platforms); employ tight risk controls given stabilizing volatility.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.