Breadth Improves, Rotation Emerges: Selective Mid-Cap Longs, Opportunistic Large-Cap Shorts

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-16

Executive Summary (2026-01-19)

Bias remains tentative long. NYSI (McClellan Summation Index) advanced steadily all week, confirming improving internal momentum. NYAD (Advance–Decline Line) printed four positive sessions before a notable negative close on Friday, signaling a pause in participation rather than a breakdown. Volatility tone stayed contained with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) holding in mid-range.

Tactically, selective long opportunities may be emerging in mid-cap industries where new highs persist and pullbacks are orderly. Short setups remain valid in large caps displaying distribution and failed breakouts. Selectivity is elevated.

Global Read

Breadth improved through Thursday and narrowed on Friday. Leadership showed early-week expansion in new highs but cooled into week-end, hinting at rotation rather than outright concentration. Volatility expanded early, then compressed, ending neutral. A minor divergence surfaced as NYSI continued to rise while NYAD turned negative on the final day. Applying the five-day consistency rule: NYSI is firmly improving; NYAD’s single down day is tentative; the aggregate pattern signals early accumulation that remains tentative pending confirmation.

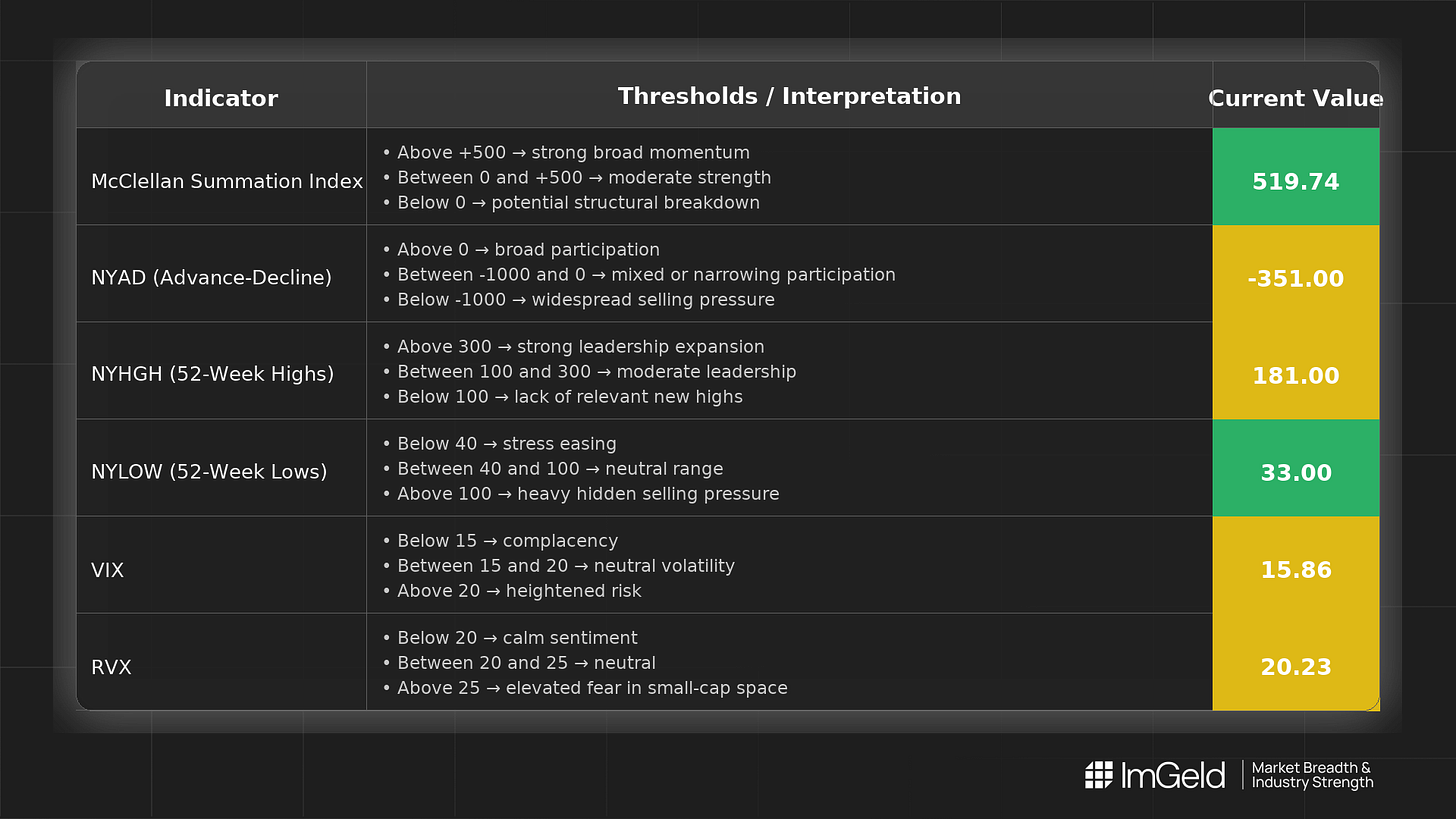

Indicator Breakdown

NYSI (McClellan Summation Index) Five consecutive gains from 340.59 to 519.74 indicate a firmly improving structure and sustained positive breadth impulse.

NYAD (Advance–Decline Line) Strong participation on 1/12, 1/13, 1/14, and 1/15 was offset by a -351 reading on 1/16. Breadth remains constructive but near term weakened, warranting caution on chasing strength.

NYHGH (New 52-Week Highs) Elevated prints with a midweek peak at 256 followed by a pullback to 181. Leadership expansion is present but cooling, consistent with rotation and digestion.

NYLOW (New 52-Week Lows) Lows remain subdued, edging from 21 to 33. Downside pressure is contained but nudging higher, a reminder to maintain risk controls.

Volatility Regime VIX moved 14.49 to 16.75 then eased to 15.86; RVX traveled 19.33 to 20.59 and settled near 20.23. The regime is neutral-to-mildly elevated, supportive of selective mid-cap long risk with hedges intact and opportunistic shorts in overextended large caps.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.