Breadth Improves, Risk Premia Expanding: Selective Mid-Cap Longs, Large-Cap Shorts

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-10

Executive Summary

Breadth has improved at the structural level but participation remains uneven. NYSI (McClellan Summation Index) advanced steadily, while NYAD (Advance–Decline Line) was negative into 12-08 before a modest positive turn on 12-09. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) are rising, pointing to a developing expansion in risk premia. New highs contracted and new lows stayed contained, signaling narrowing leadership but limited downside pressure.

Tactically, maintain a tentative long bias with high selectivity. Favor mid-cap opportunities in industries showing internal A–D resilience and rising new highs. Large-cap shorts remain valid in overextended, index-heavy industries if volatility keeps building.

Global Read

Over the last several sessions, participation is narrowing as NYHGH (New 52-Week Highs) declined and NYLOW (New 52-Week Lows) stayed low. Leadership is becoming more concentrated, not broadening. Volatility is expanding, with both VIX and RVX moving higher. A divergence persists as NYSI trends higher while NYAD was negative for most days, consistent with early accumulation but not yet confirmed by day-to-day advances. Applying the five-day consistency rule, the pattern remains tentative: improving NYSI is countered by mixed NYAD and softening leadership metrics.

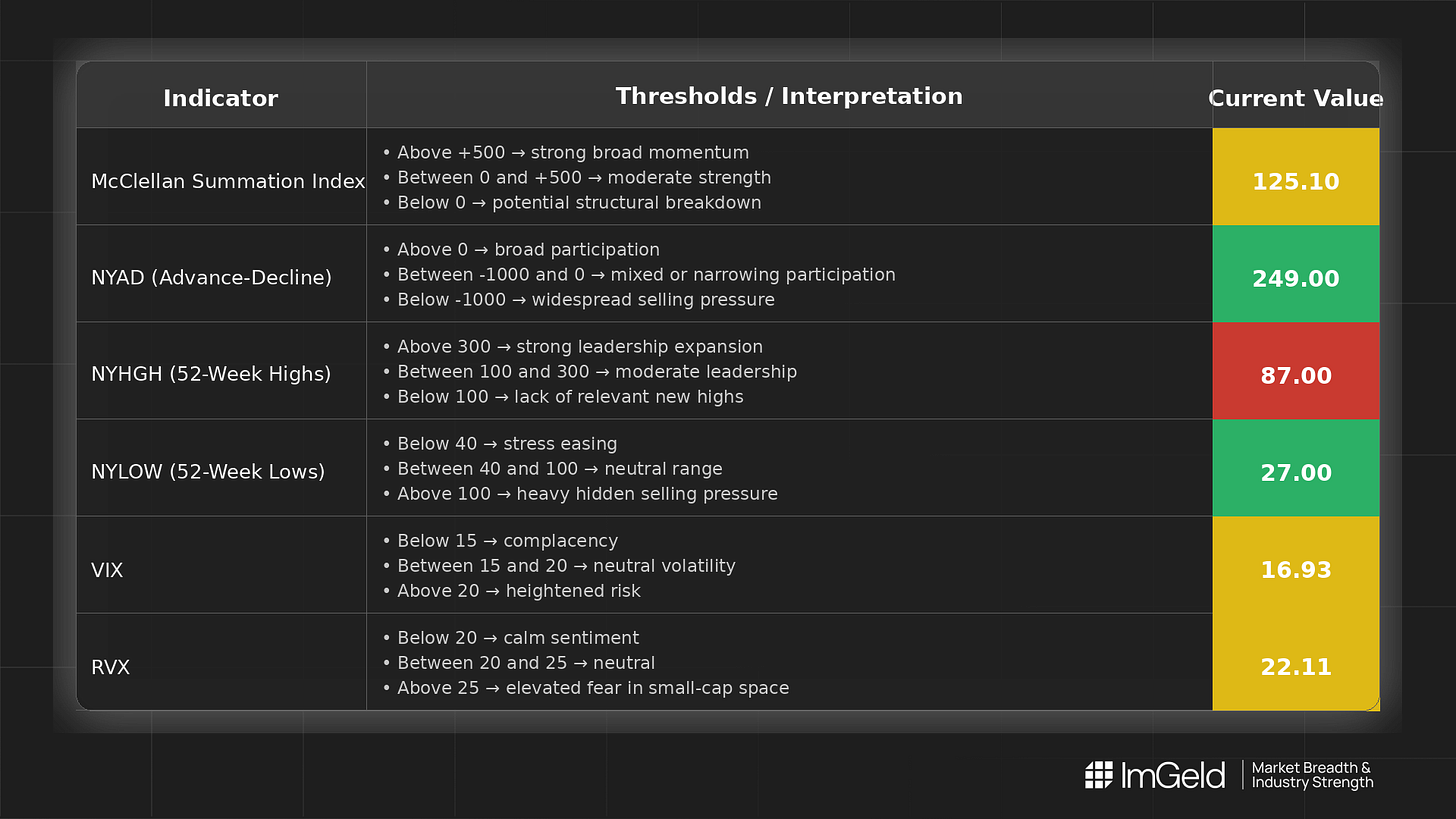

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Improving. The index rose from 114.68 to 125.10, indicating strengthening intermediate breadth despite short-term noise.

2. NYAD (Advance–Decline Line)

Weak then stabilizing. Prints were -170, -170, -945, then +249. The rebound reduces immediate pressure, but participation has not been firmly positive across days.

3. NYHGH (New 52-Week Highs)

Leadership expansion is contracting. Highs fell from 134 to 87, suggesting fewer names are carrying the tape.

4. NYLOW (New 52-Week Lows)

Downside pressure remains muted. Lows moved 33, 33, 38, then 27, consistent with contained selling and supportive of a tentative accumulation backdrop.

5. Volatility Regime

VIX climbed from 15.41 to 16.93 and RVX from 20.79 to 22.11, marking early volatility expansion. This argues for tighter risk controls, staggered entries, and disciplined profit-taking on strength.

Tactical Takeaways

- Long opportunities: Select mid-cap industries where internal breadth is turning up and new lows remain scarce, for example machinery, building products, and select software and equipment industries showing improving advance–decline profiles.

- Short opportunities: Large-cap setups are appropriate in crowded, benchmark-heavy industries that have lagged breadth and could underperform further if volatility continues to rise.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.