Breadth Flat, Volatility Compressed: Favor Selective Mid-Cap Longs; Fade Crowded Large-Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-25

Executive Summary (as of 2025-12-25)

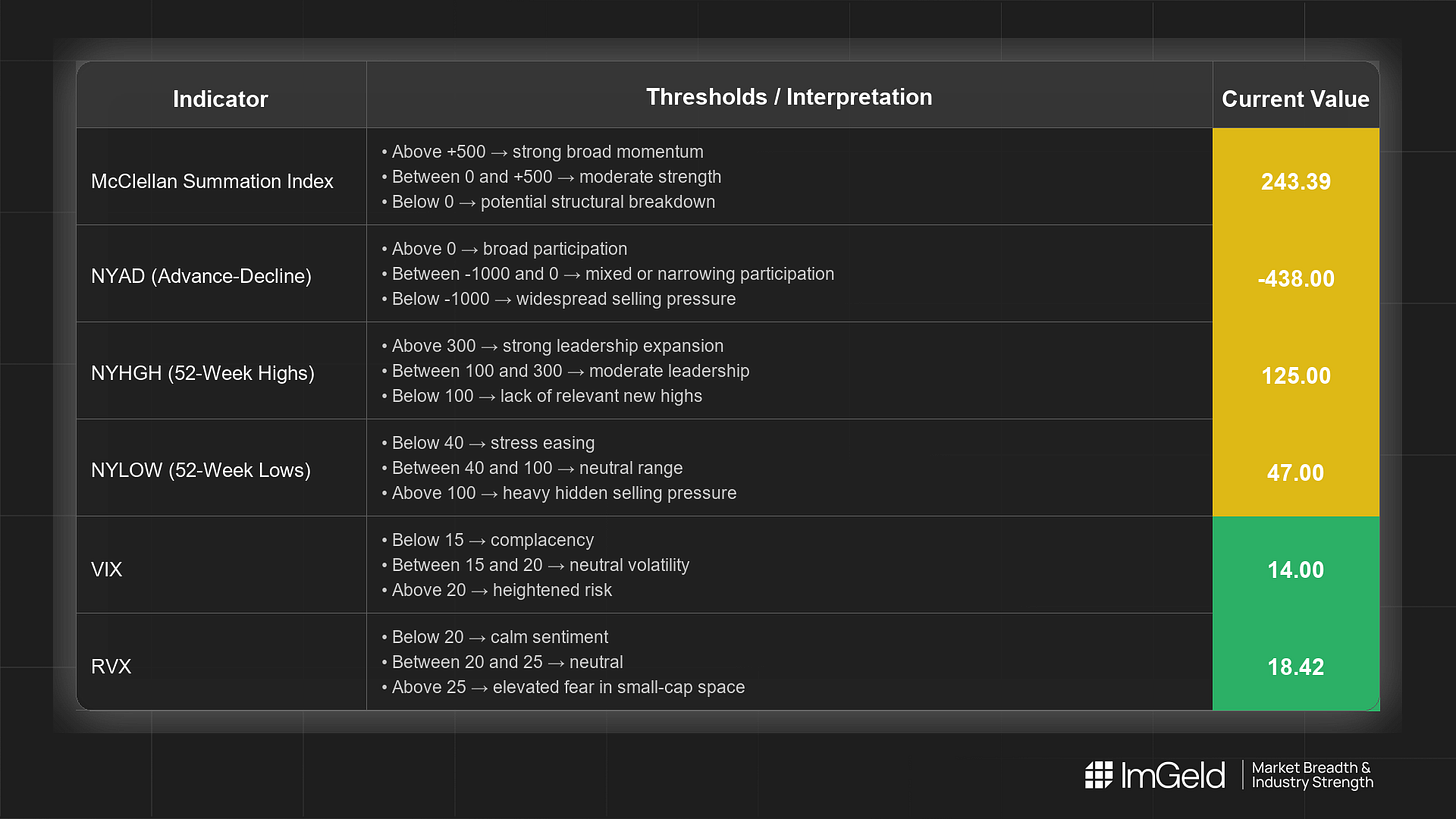

Breadth signals are stable but flat over the most recent sessions. NYSI (McClellan Summation Index) is unchanged, NYAD (Advance–Decline Line) is flat, and leadership metrics are steady with highs comfortably outpacing lows. Volatility, via VIX (CBOE Volatility Index) and RVX (Russell Volatility Index), remains compressed. This supports a tentative long tilt but requires strict selectivity.

NYSI: Sideways at 264.16, indicating momentum is intact but not expanding.

NYAD: Unchanged at 987, implying participation is not deteriorating but not broadening.

VIX/RVX: Low and stable (13.47/18.13), consistent with a carry-friendly regime, yet vulnerable to sharp reversals.

Tactically, early long setups may be emerging in selected mid-cap industries showing relative strength and new-high participation. Short opportunities remain valid in crowded large-cap leadership on failed breakouts or distribution days.

Global Read

Across the last five sessions, breadth appears to be plateauing rather than expanding. Participation is not meaningfully broadening; leadership remains selective and somewhat concentrated, with NYHGH outpacing NYLOW in a steady, not surging, manner. Volatility is compressing, maintaining a constructive backdrop for carry and mean reversion. There is no material divergence between NYSI and NYAD; both are flat. Applying the five-day consistency rule, two consecutive flat sessions qualify as Firmly, but given the absence of acceleration and incomplete five-day broadening, the pattern reads as early accumulation at best and remains Tentative pending confirmation.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure is plateauing at 264.16. The uptrend has not rolled over, but incremental thrust is absent. A decisive uptick would confirm accumulation.

NYAD (Advance–Decline Line) Daily participation is neutral at 987. Breadth is stable, not weakening, but lacks net advances needed for a durable push higher.

NYHGH (New 52-Week Highs) Steady at 91, indicating leadership exists but is not broadening aggressively. A push toward triple digits would signal improving expansion.

NYLOW (New 52-Week Lows) Subdued at 20, reflecting contained downside pressure and constructive risk appetite, supportive of selective entry on dips.

Volatility Regime VIX 13.47 and RVX 18.13 are compressed with little day-to-day change. This favors measured long executions and spread trades, but low volatility raises gap risk on exogenous shocks.

Tactical View

Longs: Focus on mid-cap industries where relative strength and high lists are holding, such as Industrial Machinery, Application Software, Specialty Chemicals, and Regional Banks. Prioritize names breaking out on rising breadth within their industry.

Shorts: Large-cap, crowded growth or index-heavy leadership remains a tactical short on failed retests or negative reversals, particularly if breadth weakens intraday.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.