Breadth Firms, Volatility Nudges Higher: Favor Selective Mid-Cap Longs, Fade Overextended Large-Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-26

Executive Summary

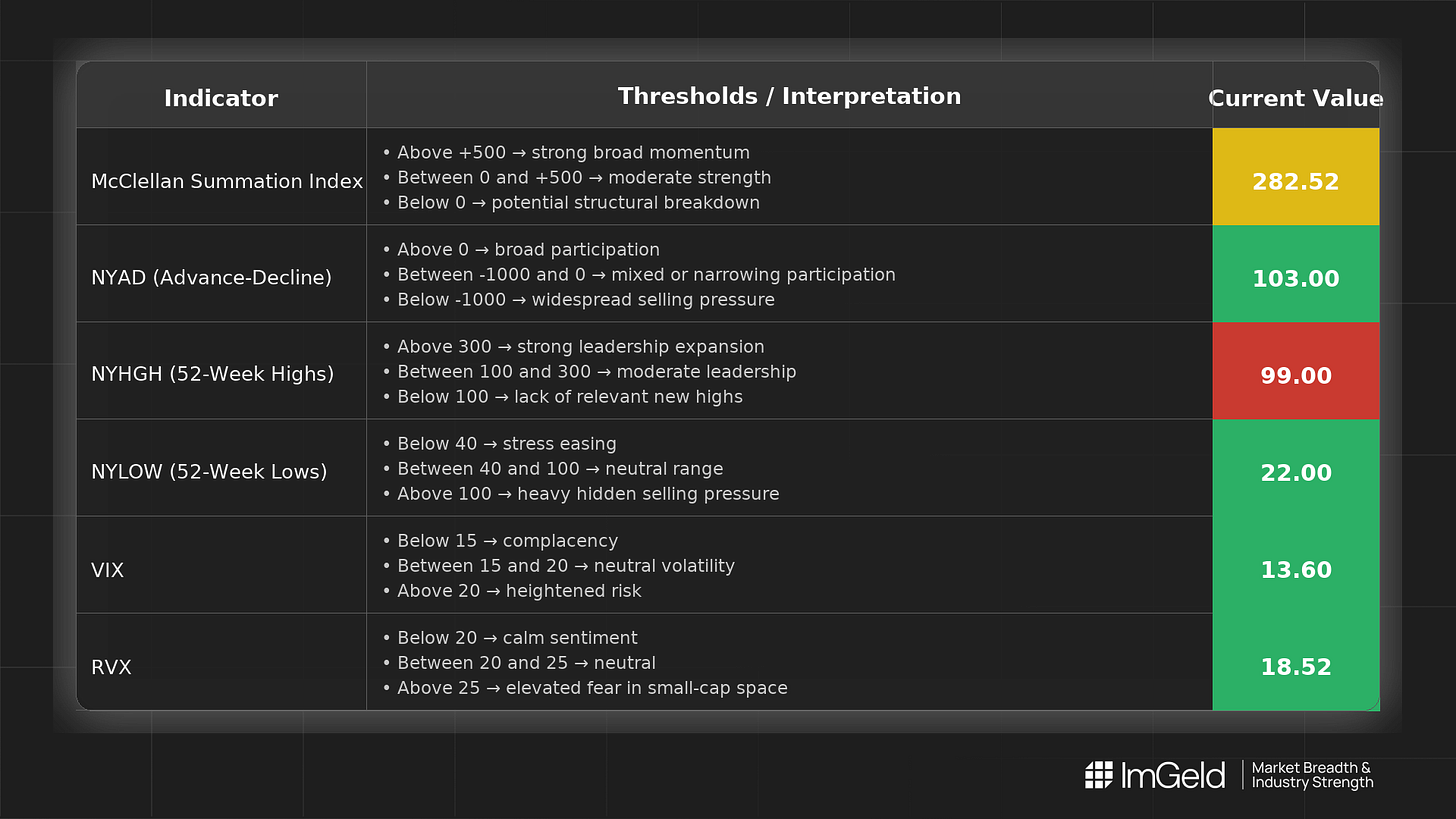

Breadth improved modestly over the last five sessions. NYSI (McClellan Summation Index) advanced from 243.39 to 282.52, while NYAD (Advance–Decline Line) flipped from a negative read to a series of positives but faded in intensity into the latest print. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) stayed low, with a slight uptick suggesting early stabilization in downside hedging demand.

Tactically, the bias remains tentative long. Long opportunities may be emerging in select mid-cap industries where participation and relative strength are improving. Short setups remain valid in overextended large-cap pockets showing deteriorating breadth. Selectivity remains high.

Global Read

Participation has improved from earlier weakness, but signals are mixed: NYSI continues to rise, yet NYAD momentum cooled, and NYHGH (New 52-Week Highs) dipped before a mild rebound. Leadership looks more concentrated, with only a tentative re-expansion in new highs. Volatility compressed into the holiday period and is now edging higher, indicating a fragile but constructive backdrop. There is a minor divergence with NYSI rising while daily NYAD moderated, consistent with early accumulation but not yet a firm continuation. Applying the five-day consistency rule: participation and leadership signals remain mixed, so the read remains tentative.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Improving. The index advanced on two distinct thrusts and held its gains during flat sessions, maintaining a positive slope and supporting a constructive intermediate tone.

2. NYAD (Advance–Decline Line)

Strengthening, then softening. After a sharp positive surge, daily breadth stayed positive but decelerated into the latest +103 read. Follow-through is needed to confirm a sustained advance.

3. NYHGH (New 52-Week Highs)

Leadership expansion paused. Highs fell from 125 to 91, then ticked up to 99, suggesting tentative broadening but not a decisive expansion.

4. NYLOW (New 52-Week Lows)

Downside pressure eased. Lows compressed from 47 to the low 20s, with a small uptick to 22 that does not yet threaten the improving risk tone.

5. Volatility Regime

VIX drifted from 14.0 to 13.6 and RVX from 18.42 to 18.52. The regime remains benign, with a slight firming that argues for disciplined risk management while maintaining a selective, pro-risk stance.

Tactical Implications

- Long: Focus on mid-cap industries demonstrating improving participation and relative strength, such as industrial machinery, specialty chemicals, regional banks, and software infrastructure, but require confirmation from sustained NYAD follow-through.

- Short: Select large-cap momentum areas that show narrowing leadership and weakening breadth into any strength.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.