Breadth Diverges, Volatility Compresses: Target Mid-Cap Longs, Short Crowded Large-Cap Leaders

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-08

Executive Summary

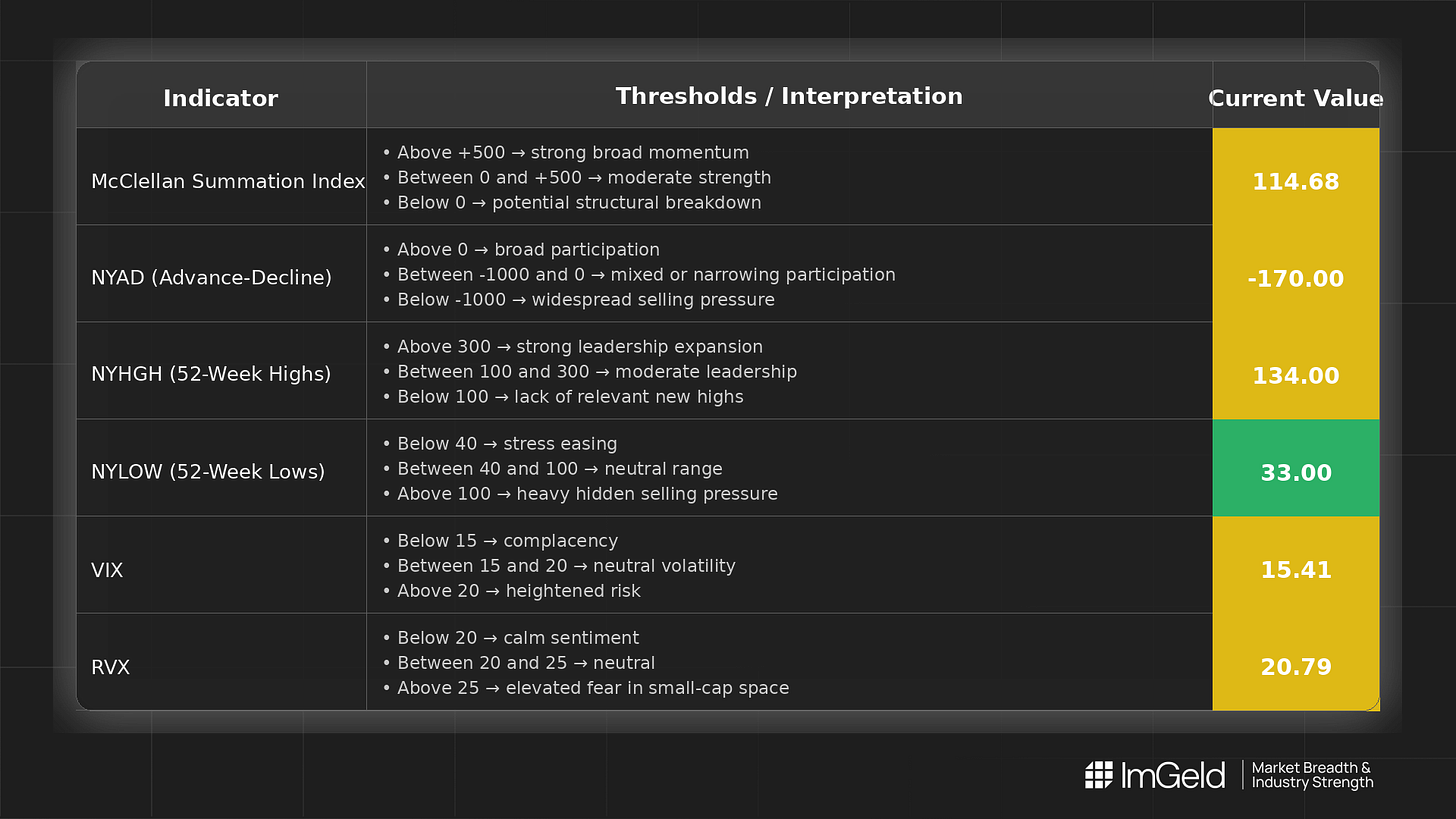

Breadth is steady but indecisive over the recent two sessions. NYSI (McClellan Summation Index) is positive and flat, while NYAD (Advance–Decline Line) remains negative, signaling near-term participation weakness against stable intermediate momentum. NYHGH (New 52-Week Highs) holds at 134 and NYLOW (New 52-Week Lows) at 33, indicating leadership is present but not broadening. Volatility is subdued with VIX (CBOE Volatility Index) near 15 and RVX (Russell Volatility Index) near 21, consistent with compression and mean-reversion risk.

Tactically, favor highly selective long work in mid-cap industries showing persistent new highs and relative strength. Short opportunities remain valid in crowded large-cap leadership where breadth is narrowing and distribution is visible. Selectivity is high.

Global Read

Participation is narrowly stable, not broadening. Leadership appears concentrated rather than rotating. Volatility is compressing, which typically suppresses trend follow-through and increases the risk of whipsaws. A mild divergence persists: NYSI is firm and flat while NYAD is negative, reflecting underlying churn. By the five-day consistency rule, the flatness across the latest sessions reads as firmly plateauing, yet the mixed relationship between NYSI and NYAD means the overall five-day pattern remains a consolidation, not clear accumulation or exhaustion.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is plateauing above zero, indicating intermediate momentum intact but stalled. No fresh thrust signal over the latest sessions.

2. NYAD (Advance–Decline Line)

Daily participation is weakening with persistent net decliners. This is a firmly negative near-term read that contradicts NYSI’s steadiness.

3. NYHGH (New 52-Week Highs)

Leadership expansion is steady, not expanding. Highs are sufficient to support selective longs but are not broad-based.

4. NYLOW (New 52-Week Lows)

Downside pressure is contained. Lows remain muted, suggesting risk appetite is intact but fragile given negative NYAD.

5. Volatility Regime

VIX and RVX are unchanged and low, indicating compression. This favors range-bound action and quick reversals. The RVX–VIX gap remains moderate, implying a contained but persistent volatility premium in smaller and mid-cap universes.

Tactical Implications

- Longs: Focus on mid-cap industries where highs persist and relative strength is improving, such as Specialty Chemicals, Electrical Equipment, Oil & Gas Equipment & Services, and Application Software.

- Shorts: Maintain or add selectively in large-cap leadership where breadth is narrowing, notably in Internet & Media, Consumer Hardware, and Broadline Retail industries, especially into weak rallies.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.”