Breadth Diverges: NYSI Up, NYAD Negative; Lean Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-29

Executive Summary As of 2026-01-28,

Breadth is cautiously constructive but wobbling. The NYSI (McClellan Summation Index) advanced for four sessions before a modest pullback, while the NYAD (Advance–Decline Line) decelerated steadily and turned negative in the last session. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) remain contained with a mild uptick from recent troughs. NYHGH (New 52-Week Highs) cooled from an early-week peak and NYLOW (New 52-Week Lows) turned higher, indicating rising selectivity.

Tactically, a tentative long bias applies only to mid-cap industries showing resilient AD on down days and an expanding highs-to-lows spread. Short setups remain valid in large caps exhibiting narrowing participation and rising lows. Selectivity is high.

Global Read

Participation is narrowing into week’s end, with leadership becoming more concentrated after a brief expansion. Volatility is stable-to-slightly higher, consistent with a guarded risk appetite. A divergence is evident: NYSI rising through day four versus a weakening NYAD that flipped negative on the last day. Under the five-day consistency rule, signals remain mixed; the pattern suggests early accumulation remains but is being tested rather than firmly continuing. Confirmation requires a return to positive daily AD alongside sustained new highs and contained new lows.

Indicator Breakdown

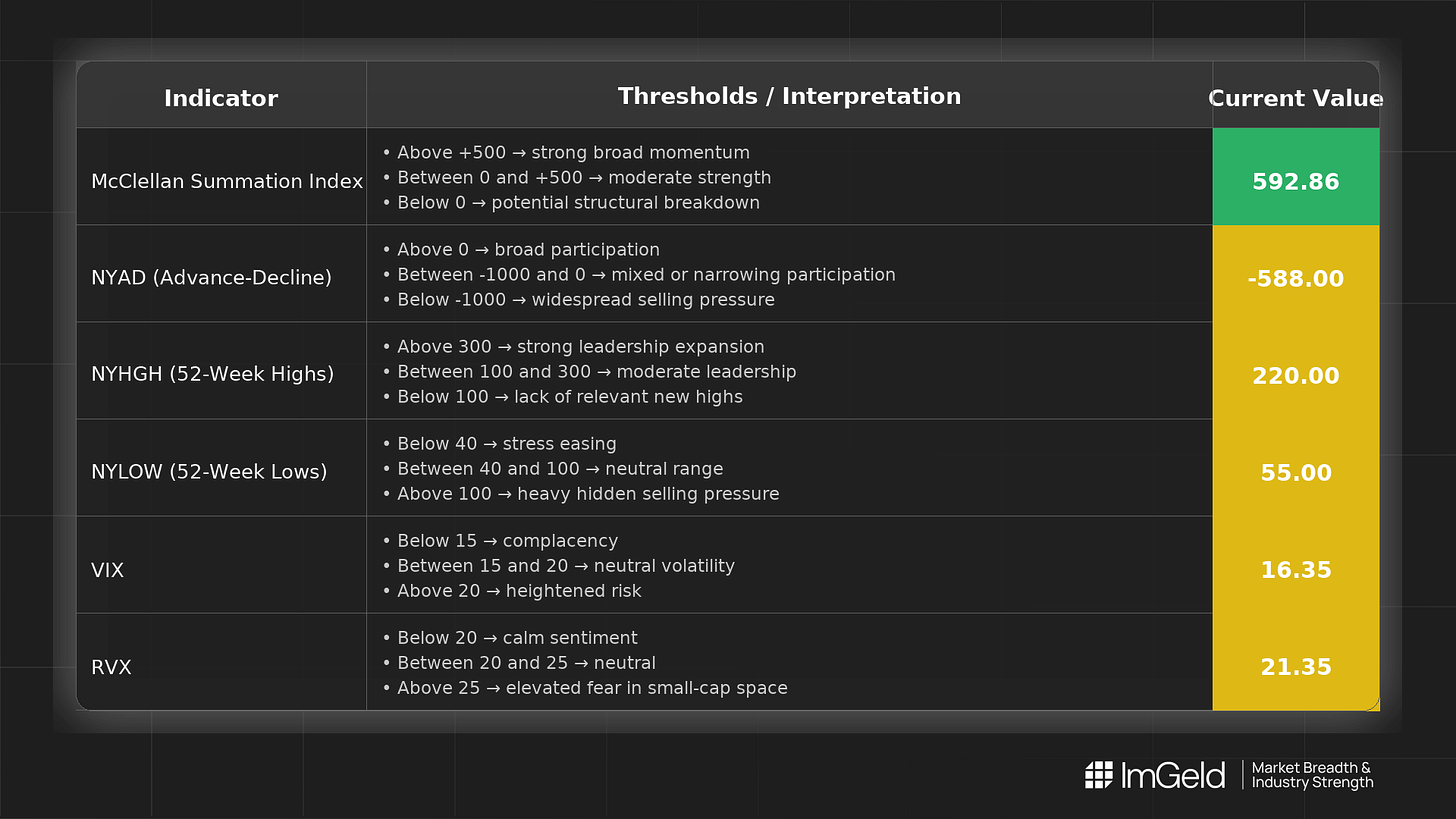

NYSI (McClellan Summation Index) Structure improved from 539.7 to 598.8 over four sessions, then eased to 592.9. Momentum is still positive but slowing, with risk of short-term plateau if participation does not reaccelerate.

NYAD (Advance–Decline Line) Daily participation weakened: 1597, 679, 57, 257, then -588. The negative final read flags deterioration beneath the surface despite an elevated NYSI, raising the bar for follow-through.

NYHGH (New 52-Week Highs) Leadership broadened early (250 to 302) before normalizing (185 to ~220). No fresh expansion, implying leadership remains selective rather than widespread.

NYLOW (New 52-Week Lows) Lows compressed early (35 to 14) but rose into the last two sessions (51, 55). Downside pressure is reappearing, a headwind for weaker groups and a warning against indiscriminate risk.

Volatility Regime VIX dipped to 15.64, then firmed to 16.35 and held; RVX showed a similar mild back-up around 21.3–21.9. The regime is low-to-moderate with slight re-expansion, favoring disciplined entries and respecting overhead supply on rallies.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.