Breadth Divergence, Volatility Repricing: Selectivity Key—Favor Mid-Cap Strength, Fade Crowded Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-09

Executive Summary

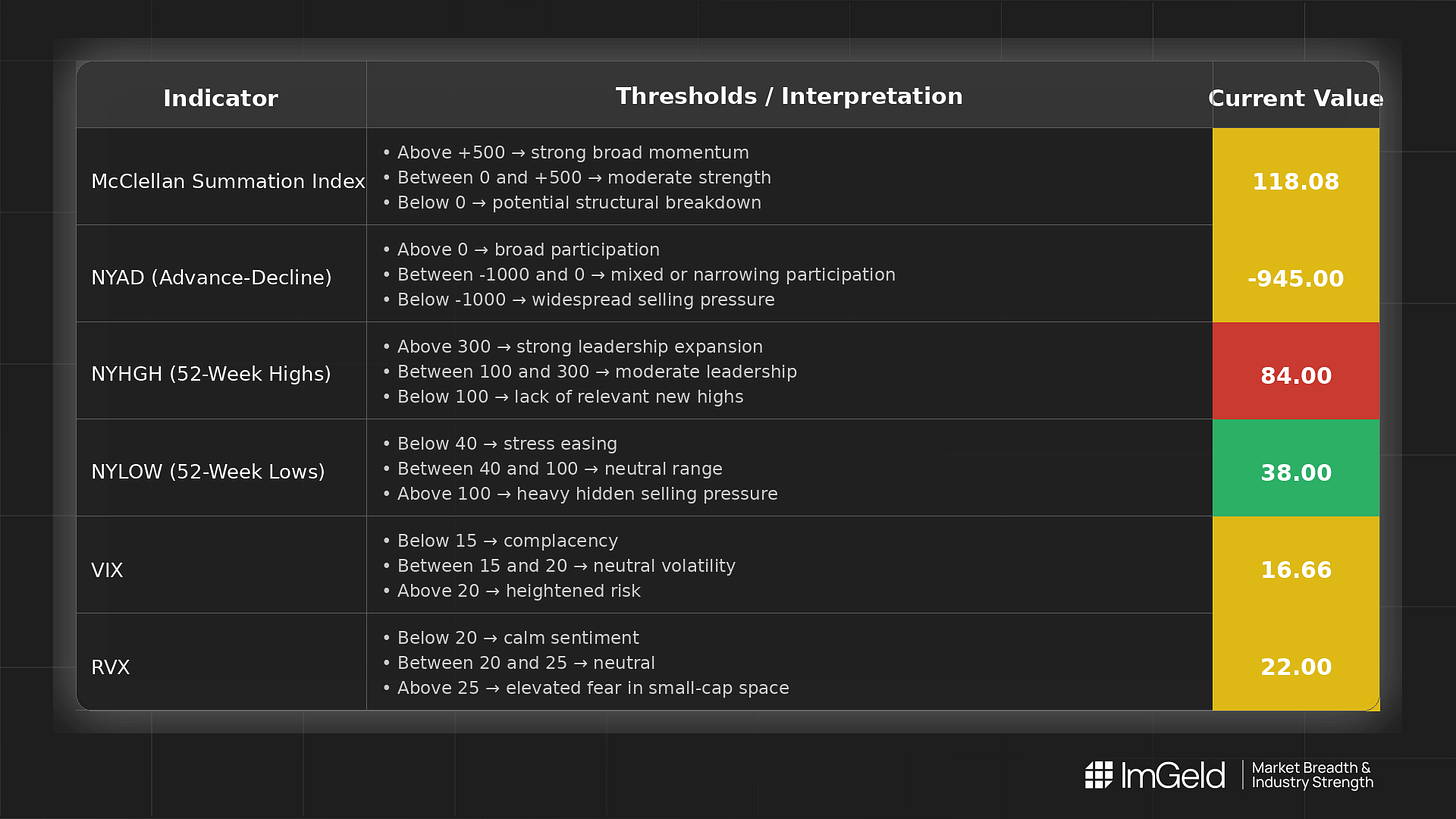

Across the latest week, breadth is mixed: NYSI (McClellan Summation Index) edged higher, while NYAD (Advance–Decline Line) deteriorated sharply. NYHGH (New 52-Week Highs) contracted and NYLOW (New 52-Week Lows) ticked up. Volatility firmed, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both rising. Bias remains neutral with elevated selectivity. Long opportunities may be emerging in resilient mid-cap industries with steady leadership and contained drawdowns. Short setups remain valid in deteriorating large-cap pockets where participation is thinning and volatility is re-pricing.

Global Read

Participation is narrowing as NYAD weakened into deeper negative territory while NYSI rose, indicating a divergence between trend and day-to-day participation. Leadership is becoming more concentrated, reflected by falling NYHGH and a modest rise in NYLOW. Volatility is expanding, with both VIX and RVX lifting from recent lows, signaling a rebuilding risk premium. Given the mixed signals within the five-day window, the pattern remains mixed rather than firmly trending, pointing to a late-stage advance with early distribution rather than clean accumulation. Selectivity and timing are critical.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is improving, rising from 114.68 to 118.08, indicating the intermediate trend is still constructive even as participation softens.

2. NYAD (Advance–Decline Line)

Daily participation weakened materially, slipping from -170 to -945, signaling broad selling pressure beneath index levels.

3. NYHGH (New 52-Week Highs)

Leadership expansion narrowed from 134 to 84, consistent with a thinning advance and increased concentration in a smaller cohort of winners.

4. NYLOW (New 52-Week Lows)

Lows rose modestly from 33 to 38, suggesting incremental downside pressure and waning risk appetite, though not yet disorderly.

5. Volatility Regime

VIX climbed from 15.41 to 16.66 and RVX from 20.79 to 22.00, indicating a shift toward a higher-volatility regime. This supports staggered entry tactics, tighter risk controls, and a preference for relative-strength longs over beta exposure.

Tactical Take

- Longs: Favor mid-cap industries showing resilient relative strength and stable net new highs, such as aerospace and defense suppliers, specialty chemicals, life science tools, select specialty insurers, and capital equipment with backlog support.

- Shorts: Focus on large-cap areas displaying breadth deterioration and crowding risk, including mega-cap consumer internet, select semiconductor bellwethers, and integrated energy where momentum is fading.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry