Breadth Deteriorates, Volatility Surges: Leadership Narrows—Barbell Mid-Caps Long, Large-Caps Short

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-20

Executive Summary Date: 2026-01-20

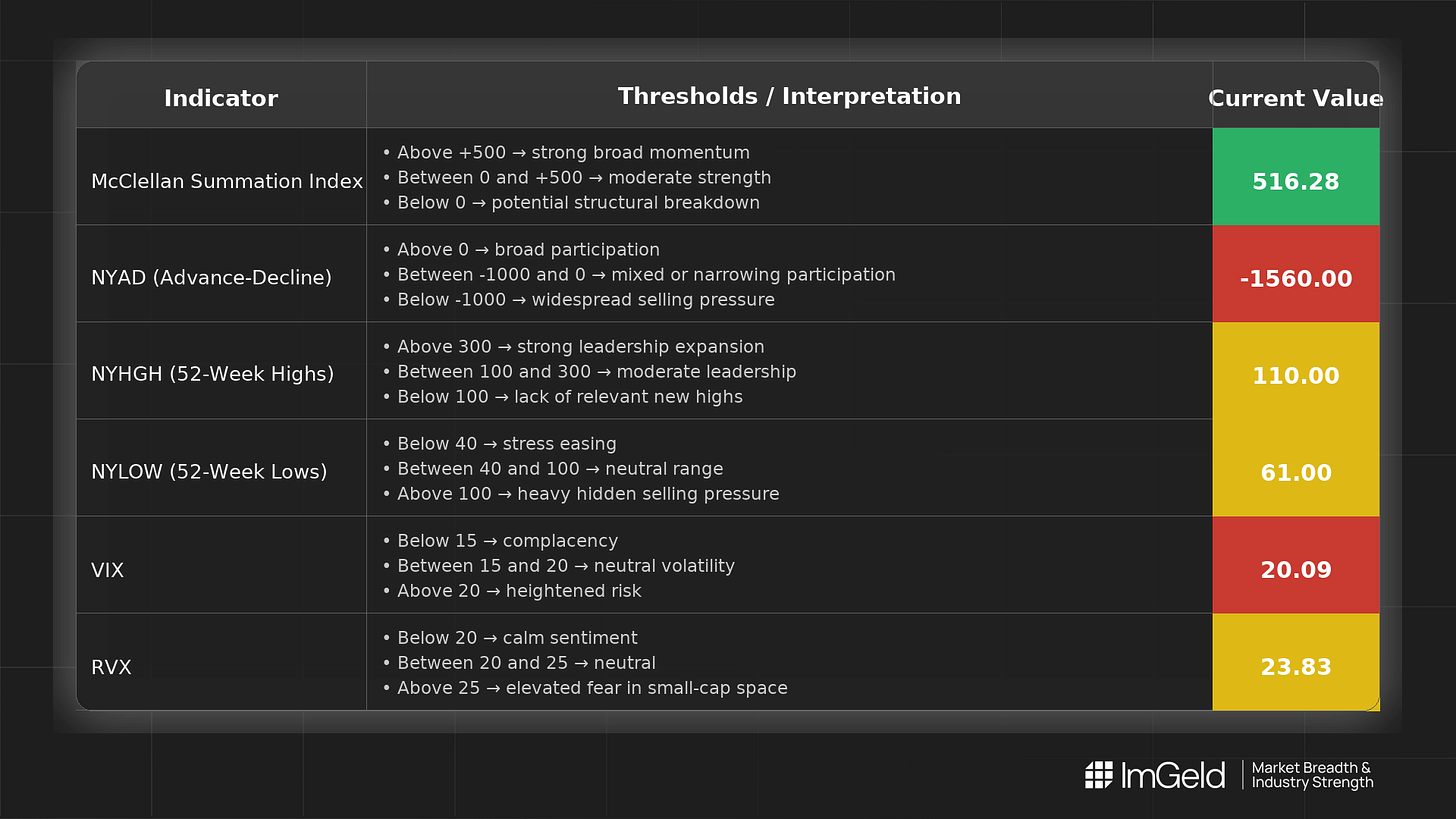

Breadth turned mixed-to-weak over the last five sessions. NYSI (McClellan Summation Index) advanced early and then stalled, while NYAD (Advance–Decline Line) flipped decisively negative. Volatility shifted higher with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) spiking. NYHGH (New 52-Week Highs) contracted and NYLOW (New 52-Week Lows) expanded, signaling narrowing leadership and rising downside pressure. Selectivity is critical: potential long opportunities are limited to resilient mid-caps within steady industries on controlled pullbacks; short setups remain valid in large-cap momentum cohorts and in industries showing deteriorating breadth.

Global Read

Participation is narrowing as the week progressed, with leadership becoming more concentrated. Volatility moved from compression to expansion late in the window. A divergence emerged: NYSI stayed elevated after earlier gains while NYAD weakened sharply, a classic late-phase tell that breadth thrusts are losing follow-through. Using the five-day consistency rule: participation narrowing is firmly in place (three consecutive weak NYAD prints), volatility expansion is tentative (one-day spike), and the pattern leans toward exhaustion risk rather than continuation. This favors a barbell of selective mid-cap long exposure in stable industries and opportunistic shorts in stretched large-cap groups, with tighter risk controls.

Indicator Breakdown

1. NYSI (McClellan Summation Index): 440.32 → 516.28. Structure improved for three sessions, then plateaued and slipped modestly. Momentum is fading but not yet broken.

2. NYAD (Advance–Decline Line): +804, +967, −351, −351, −1,560. Participation weakened materially, culminating in broad downside on the latest session. Breadth is firmly deteriorating.

3. NYHGH (New 52-Week Highs): 210, 256, 181, 181, 110. Leadership expansion reversed; new highs contracted steadily, pointing to concentration at the top.

4. NYLOW (New 52-Week Lows): 30, 28, 33, 33, 61. Lows expanded, indicating rising stress and softening risk appetite.

5. Volatility Regime: VIX 16.75/15.84/15.86/15.86/20.09 and RVX 20.59/20.09/20.23/20.23/23.83. Four days of quiet followed by an abrupt volatility expansion. Tactically, avoid chasing breakouts, favor staggered entries, and keep gross exposure moderated with hedges.

Tactical Take

- Longs: Only in selective mid-cap names within resilient, cash-generative industries showing relative-strength stability despite the pullback. Prefer pullback entries with defined risk.

- Shorts: Remain valid in large-cap momentum industries where breadth has rolled over and volatility is expanding, including crowded growth complexes. Fade bounces rather than press breakdowns late.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.