Breadth Deteriorates, Volatility Firms: Tentative Short Bias Amid Fragile Tape

IMGELD Market Breadth Update: 2025-11-05 10:14:52

Executive Summary (as of 2025-11-05)

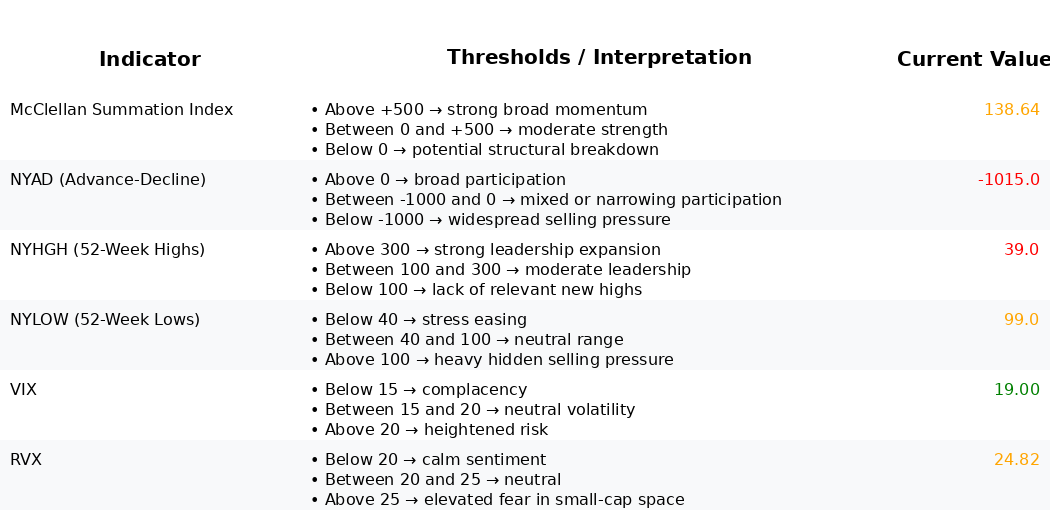

Over the past five sessions, internal momentum weakened. Portfolio bias: TENTATIVE SHORT, with indicative allocation of 30% Long, 35% Short, and 35% Cash. Breadth direction is soft: the McClellan Summation Index (NYSI) remains positive but fell from ~201 to ~139, while the Advance–Decline Line (NYAD) turned decisively negative. Volatility tone is firming, with CBOE Volatility Index (VIX) up to ~19 and CBOE Russell 2000 Volatility Index (RVX) near ~24.8. Tactically, keep long exposure narrowly focused on high-quality leaders holding trend support, and deploy shorts in structurally weak, below-trend groups. Maintain a meaningful cash buffer and respect rising volatility.

Global Read

Structural breadth narrowed over the last five sessions. McClellan Summation Index (NYSI) is still above zero, which is constructive in level, but its decline signals fading participation. Advance–Decline Line (NYAD) flipped deeply negative on back-to-back sessions, indicating distribution. Leadership deteriorated: NYHGH compressed from 64 to 39 with an intraday trough near 10, while NYLOW hovered in the mid to high 90s. NYLOW below 40 is healthy and above 100 is risk-off; current prints are uncomfortably close to risk-off territory.

Volatility rose in tandem with weakening breadth. CBOE Volatility Index (VIX) moved from 17.4 to about 19 and CBOE Russell 2000 Volatility Index (RVX) from 23.4 to ~24.8, elevating risk premia without signaling capitulation. The interaction of softer participation, thinning leadership, and firming volatility points to a fragile tape and a higher probability of failed rallies.

Over a 3–8 week horizon, the base case tilts toward choppy to lower with episodic spikes in volatility unless breadth stabilizes. Confirmation of the current tentative short setup would include: Advance–Decline Line (NYAD) remaining negative, NYLOW sustaining above 100, McClellan Summation Index (NYSI) rolling down toward zero, and CBOE Volatility Index (VIX) closing above 20. Invalidation would require: consecutive positive Advance–Decline Line (NYAD) sessions, McClellan Summation Index (NYSI) turning up and advancing toward or above prior ~200 reads, NYHGH expanding sustainably above 100, NYLOW declining below 40, and CBOE Volatility Index (VIX) slipping back under 17 with CBOE Russell 2000 Volatility Index (RVX) easing below ~23. Until then, keep risk tight, emphasize relative-strength longs in defensives and quality megacaps, and lean into shorts in lagging cyclicals, small caps, and unprofitable growth that are failing at key moving averages.

Market Breadth Summary

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.