Breadth Deteriorates, Volatility Elevated — Stay Selective: Mid-Cap Longs, Large-Cap Shorts

ImGeld Market Breadth Update | Based on last closing Date: 2025-11-21

Executive Summary

Breadth deteriorated through the week with NYSI (McClellan Summation Index) falling steadily into negative territory, while NYAD (Advance–Decline Line) was mixed and closed with a strong up day. Volatility remained elevated as VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) expanded mid-week and partially compressed by Friday, keeping conditions choppy. With a Neutral bias and balanced 25/25 exposure, we maintain a selective stance: potential long setups are limited to mid-cap industries showing relative-strength stabilization; short setups remain valid in fatigued, over-owned large caps and weak cyclical industries. Selectivity and timing remain paramount.

Global Read

Participation narrowed across the week as NYSI declined for five straight sessions, while NYAD alternated and finished with a rebound, signaling a divergence between cumulative breadth deterioration and late-week participation. Leadership remains concentrated, with NYHGH (New 52-Week Highs) flat-to-muted and no evidence of expansion; NYLOW (New 52-Week Lows) stayed elevated despite easing Friday. Volatility expanded into Thursday and eased Friday, indicating risk remains two-sided with headline sensitivity. By the five-day consistency rule, NYSI is firmly weakening; NYAD remains mixed; volatility expansion is firm for most of the week with tentative compression late. The pattern suggests continuation of deterioration with tentative counter-trend accumulation attempts rather than a durable turn.

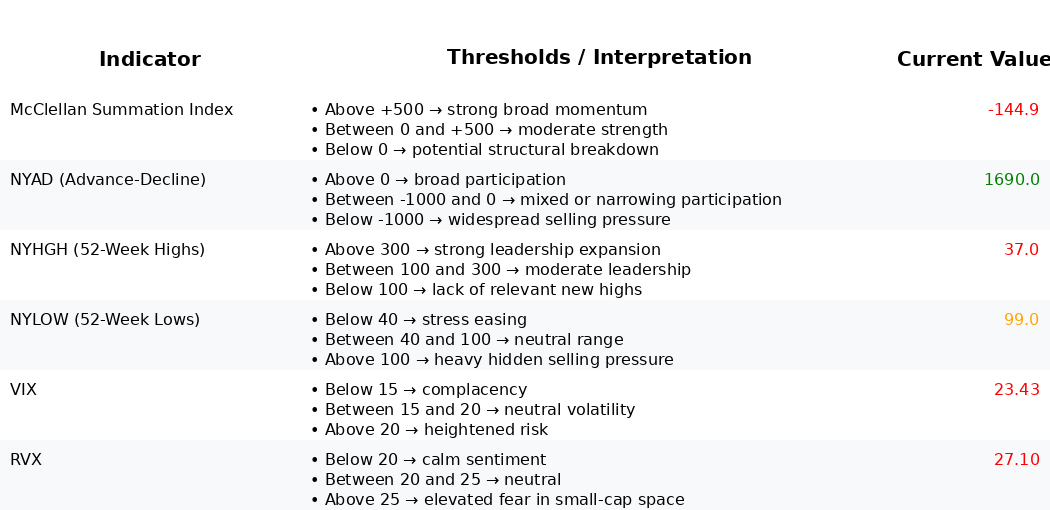

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Firm decline from 31.74 to -144.89 across all five sessions. Structure is decisively weakening, confirming a negative breadth trend.

2. NYAD (Advance–Decline Line)

Three negative days (-1824, -650, -1542) offset by two positives (+184, +1690). Participation remains mixed; Friday’s rebound looks more corrective than structural given NYSI’s downtrend.

3. NYHGH (New 52-Week Highs)

Stalled in the mid-30s to mid-40s, indicating no leadership expansion. Upside leadership remains narrow.

4. NYLOW (New 52-Week Lows)

Persistently triple-digit prints, easing to 99 on Friday. Downside pressure is moderating but not resolved, implying fragile risk appetite.

5. Volatility Regime

VIX rose to 26.42 before easing to 23.43; RVX peaked at 29.59 then slipped to 27.10. Elevated, non-trending volatility supports tactical, staggered execution and disciplined risk, favoring partial positions and quick adjustments.

Tactics

- Long: Only in selective mid-cap industries exhibiting improving internal breadth on pullbacks and resilience against new lows.

- Short: Remains valid in large-cap leaders showing distribution and in industries with persistent net decliners and elevated new lows. Maintain tight risk and avoid chasing late moves.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.