Breadth Deteriorates, Volatility Climbs: Maintain Defensive Short Tilt; Selective Mid-Cap Longs

ImGeld Market Breadth Update | Date: 2025-11-17

Executive Summary

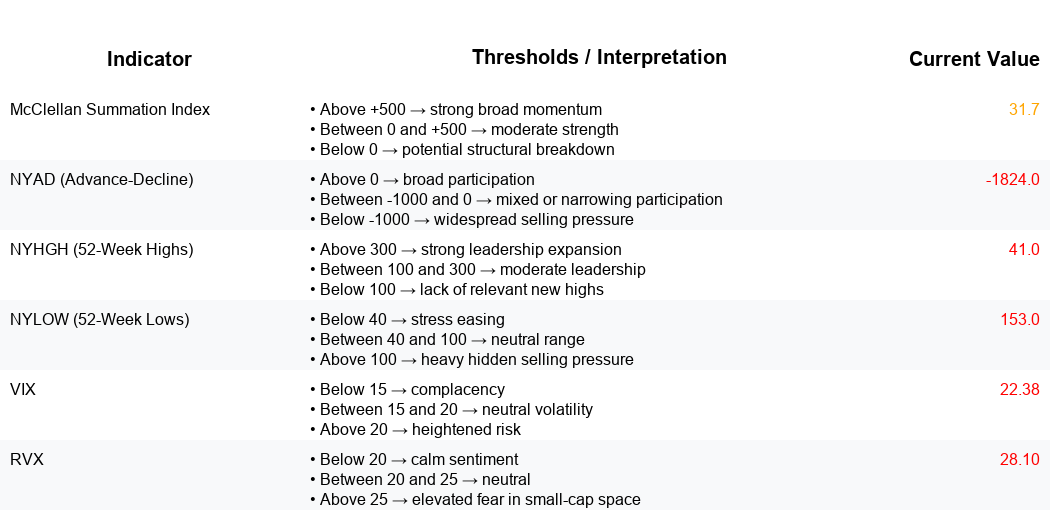

Breadth softened as NYSI (McClellan Summation Index) reversed lower and NYAD (Advance–Decline Line) turned decisively negative. Volatility expanded, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) rising steadily.

Tactically, any long exposure should be highly selective and focused on resilient mid-cap industries showing relative strength. Short setups remain valid, including in large caps where weakness is confirmed.

Global Read

Participation is firmly narrowing: new highs fell each day while new lows expanded. Leadership is becoming more concentrated, tilting to defensives, with little evidence of broad leadership rotation. Volatility is firmly expanding, lifting risk premiums and reducing the tolerance for weak balance sheets or high-multiple profiles. There is no constructive divergence; NYSI and NYAD are aligned lower after a brief uptick failed. The five-day pattern signals a continuation of deterioration rather than early accumulation or exhaustion.

Market Breadth Summary (Last Five Sessions)

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is declining: after a brief rise on 11-12, NYSI rolled over across three consecutive sessions, indicating weakening intermediate breadth.

2. NYAD (Advance–Decline Line)

Daily participation weakened materially, with three strongly negative days out of five and the deepest downside on 11-17, pointing to broad selling pressure.

3. NYHGH (New 52-Week Highs)

Leadership expansion contracted from 159 to 41, indicating shrinking leadership and limited breakout quality.

4. NYLOW (New 52-Week Lows)

Downside pressure intensified, rising from 49 to 153. Elevated new lows signal deteriorating risk appetite and growing distribution.

5. Volatility Regime

VIX rose from 17.3 to 22.4 and RVX from 23.6 to 28.1, a firm expansion regime. Expect wider ranges, faster factor rotations, and a higher bar for adding risk.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.