Breadth Deteriorates, New Lows Rise: Distribution Builds—Bias Short, Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-01

Executive Summary Date: 2026-01-02

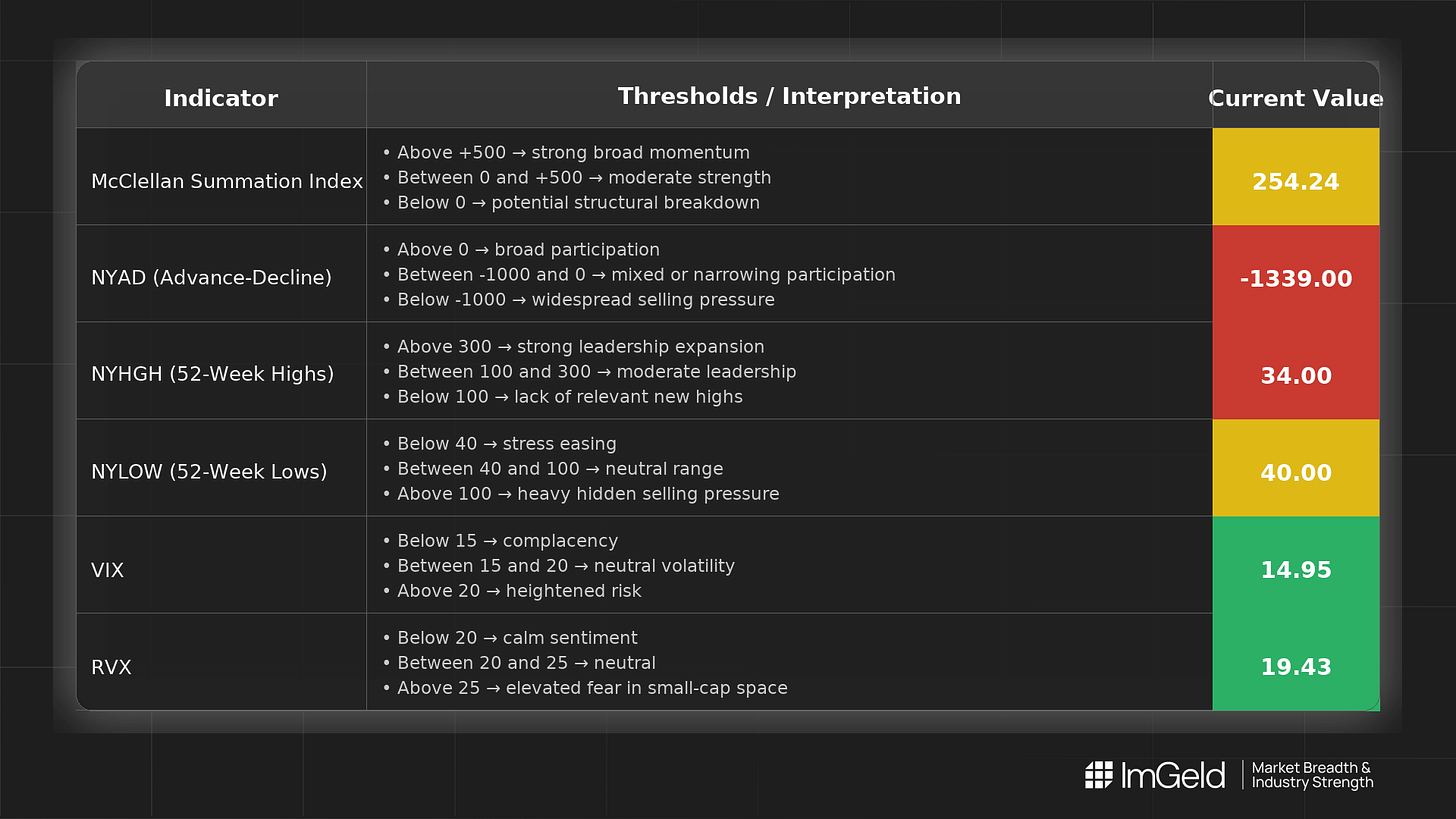

Breadth softened over the last five sessions. NYSI (McClellan Summation Index) fell from 284.26 to 254.24, then stalled for three sessions. NYAD (Advance–Decline Line) stayed negative throughout and locked at -1339 for the last three days, signalling persistent broad selling. NYHGH (New 52-Week Highs) faded from 48 to 34 while NYLOW (New 52-Week Lows) rose from 22 to 40 and held. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) drifted higher to 14.95 and 19.43, respectively, indicating mild volatility expansion. Tactically, the tape supports a tentative short bias. Selective long opportunities may be emerging only in resilient mid-cap industries with stable cash flows and improving relative strength. Short opportunities remain valid in overextended large caps and economically sensitive industries where breadth is breaking down. Selectivity is high.

Global Read

Participation is narrowing as declines broaden and new highs contract. Leadership is becoming more concentrated, with fewer issues carrying returns. Volatility is gently expanding, consistent with a developing distribution phase rather than panic. A mild divergence is present: NYSI has plateaued while NYAD is firmly negative, implying internal weakness not yet reversed by summation. By the five-day consistency rule, NYAD weakness is firmly established (3 days consistent), while NYSI’s stall keeps the deterioration tentative on a summation basis. The five-day pattern points to continuation risk rather than exhaustion; early accumulation signals are not yet evident.

Indicator Breakdown

NYSI (McClellan Summation Index) Declining into midweek, then flat for three sessions at a lower level. Structure remains weak and unresolved; no confirmed upturn.

NYAD (Advance–Decline Line) Negative all five days, with three consecutive days at -1339. Breadth is firmly weakening; buyers are not offsetting broad declines.

NYHGH (New 52-Week Highs) Compressed from 48 to 34 and stayed there. Leadership expansion is limited; breakouts are not propagating.

NYLOW (New 52-Week Lows) Climbed to 40 and remained elevated. Downside pressure and risk aversion are increasing.

Volatility Regime VIX rose from 14.2 to 14.95 and RVX from 19.18 to 19.43, then stabilized. Mild expansion argues for disciplined risk control, avoiding chase behavior, and favoring staggered entries.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.