Breadth Deteriorates, New Lows Expand; Maintain Defensive Tilt as Downside Risk Builds

IMGELD Market Breadth Update: 2025-10-31 08:55:52

Executive Summary

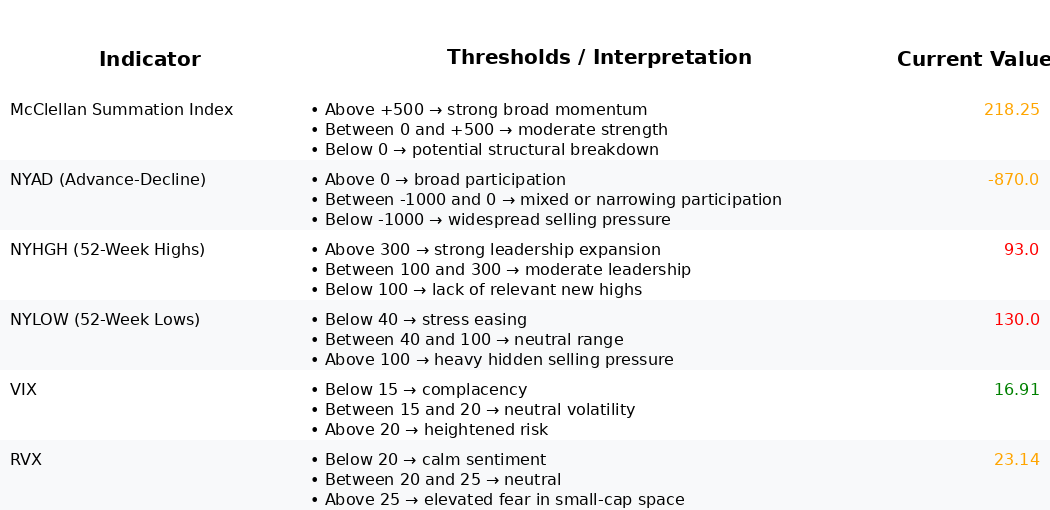

Over the past five sessions, internal tone has weakened. The portfolio bias is NEUTRAL, with an indicative allocation of 25% Long, 50% Short, and 25% Cash. Breadth momentum is rolling over: the McClellan Summation Index (NYSI) remains positive but declined from 259 to 218, while the NYSE Advance–Decline (NYAD) has been negative for four straight sessions. Volatility is drifting higher but contained, with VIX rising to ~16.9 and RVX stable near ~23.

Tactically, maintain a defensive tilt. Favour selective longs with persistent relative strength and robust fundamentals, and emphasize short exposure in areas showing expanding new lows and weak participation. Preserve the cash buffer and fade rallies into resistance while volatility remains contained. Downside risk is building but not yet fully confirmed.

Global Read

Breadth has deteriorated and is narrowing. NYSI remains above zero near 218, which is constructive in absolute terms, but the three-session decline signals fading momentum. NYAD printed -702, -1173, and -870 after an initial positive day, indicating persistent distribution pressure

Leadership is contracting. NYHGH oscillated 124 to 152 early in the week but fell back to 93. New lows expanded from 22 to 130 and have held above 100, a risk-off threshold that historically accompanies corrective phases if sustained. This deterioration in the highs-lows complex outweighs the still-positive NYSI.

Volatility remains neutral to cautious. VIX drifted from 15.97 to 16.91 and RVX hovered near 23. The absence of a volatility spike tempers near-term downside confirmation but does not negate the breadth damage.

Three to eight week outlook: baseline is range-bound with a negative skew. Confirmation of a deeper corrective phase would be signaled by NYSI turning down through zero, sustained NYLOW above 100, continued negative NYAD, and a volatility expansion with VIX above 18 to 20 and RVX above 25. Invalidation of downside risk would require a breadth repair: multiple sessions of positive NYAD, NYLOW dropping and persisting below 40, NYHGH expanding and holding above 150 to 200, and NYSI turning higher through 260 to 300.

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.