Breadth Cracks: NYSI Sub-Zero, NYAD Weak, Volatility Expands—Maintain Tentative Short Bias

ImGeld Market Breadth Update Date: 2025-11-19

Executive Summary

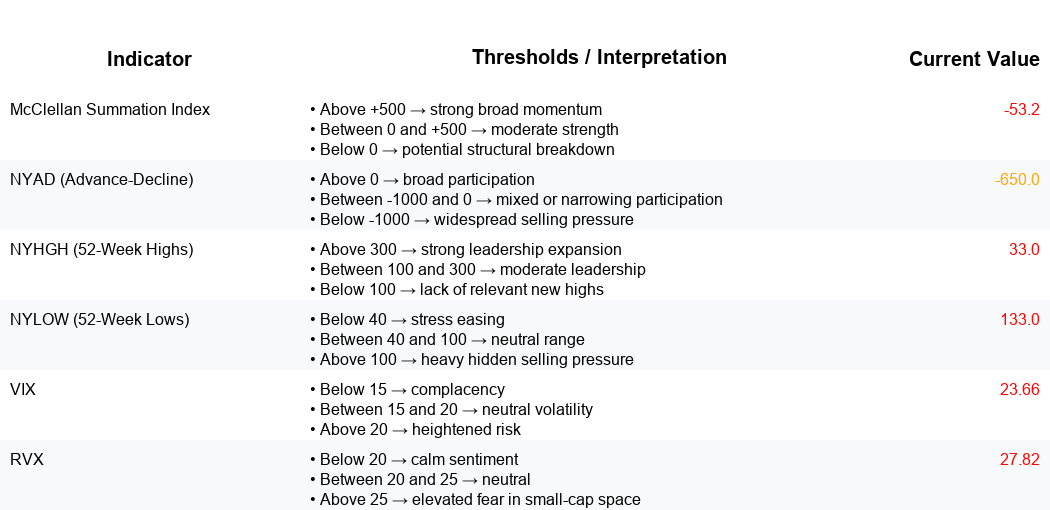

Breadth direction: NYSI (McClellan Summation Index) rolled over sharply and crossed below zero; NYAD (Advance–Decline Line) remained net negative in 4 of 5 sessions.

Volatility tone: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) expanded, sustaining a risk-off regime.

Tactically, potential long opportunities are limited to highly selective mid-cap leadership pockets within defensive or counter-cyclical industries showing stable relative strength. Short setups remain valid in weakening cyclicals and in large-cap growth-heavy industries when weakness is confirmed. Selectivity should be high.

Global Read

Participation is narrowing as NYAD delivered four negative prints out of five while NYSI declined each day and turned negative, signaling firm deterioration rather than an isolated wobble. Leadership is becoming more concentrated, with NYHGH falling and NYLOW elevated, indicating contraction at the top and broadening downside pressure beneath the surface. Volatility is expanding, as both VIX and RVX trended higher. Any brief NYAD improvement on 11/18 was insufficient to offset the five-day deterioration, so there is no meaningful divergence between NYSI and NYAD. By the five-day consistency rule, breadth is firmly weakening, consistent with continuation rather than early accumulation.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Decisively declining across all five sessions, dropping from 102.07 to -53.24 and moving below zero, confirming a negative intermediate breadth trend.

2. NYAD (Advance–Decline Line)

Net advances were negative on 11/13, 11/14, 11/17, and 11/19, with only a modest positive on 11/18. Cumulative breadth over five days is decisively negative, signaling weakening participation.

3. NYHGH (New 52-Week Highs)

Leadership expansion deteriorated from 86 to 33, indicating narrowing upside leadership and reduced risk appetite for new leadership breakouts.

4. NYLOW (New 52-Week Lows)

New lows rose and remain elevated (90 to 133), underscoring persistent downside pressure and an unfavorable tape for broad risk-taking.

5. Volatility Regime

VIX increased from ~20 to the mid-20s and RVX from mid-26s to high-27s, reflecting expanding volatility. Elevated and rising volatility favors risk management, quicker trade horizons, and respect for whipsaw risk.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.