Breadth Broadens, Volatility Eases: Early Accumulation Favors Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-24

Executive Summary Date: 2026-01-23

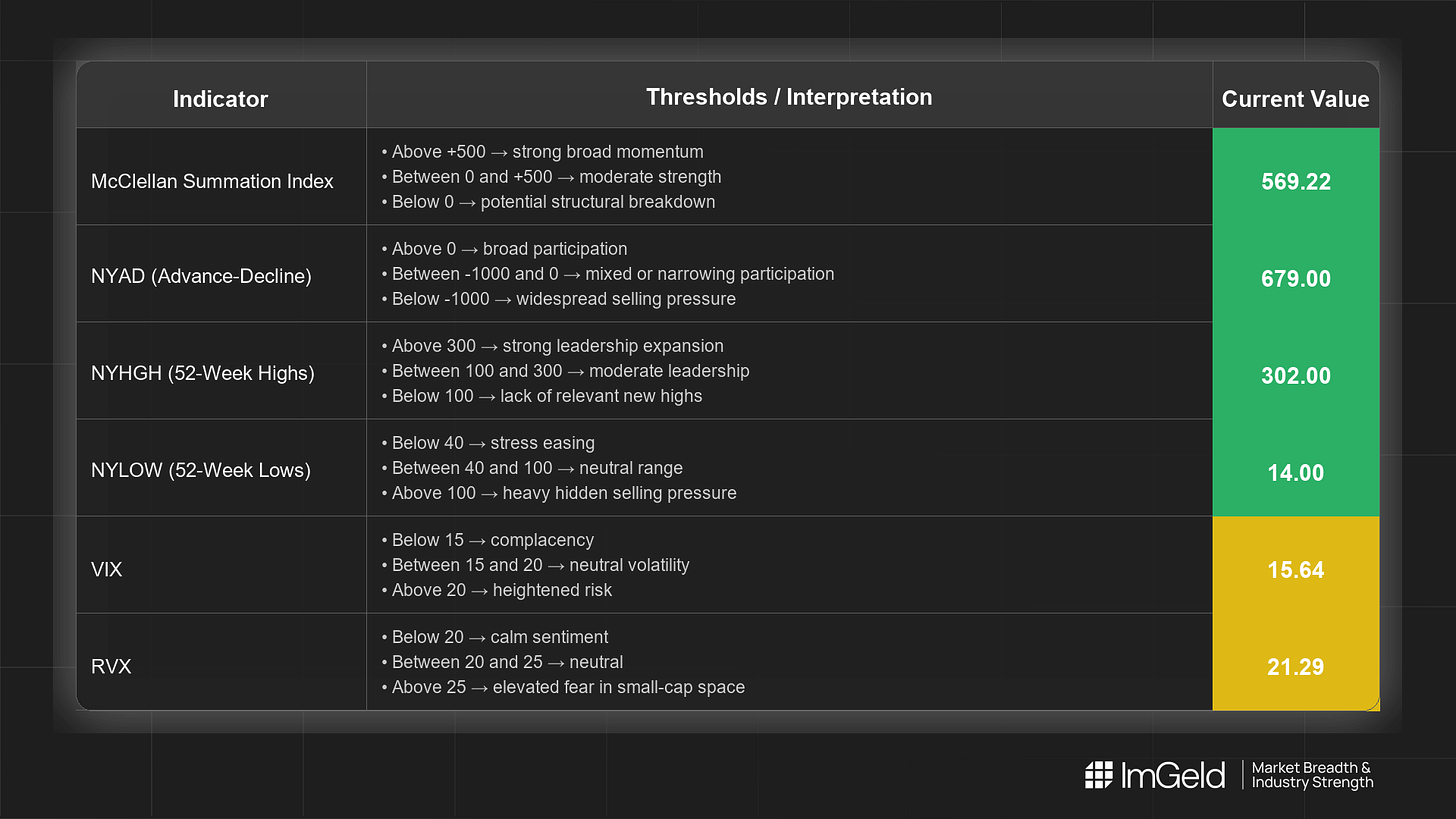

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) advanced and stabilised at elevated levels, NYAD (Advance–Decline Line) turned positive for three straight days, NYHGH (New 52-Week Highs) accelerated, and NYLOW (New 52-Week Lows) compressed. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) retraced a midweek spike back toward subdued regimes. Tactical bias is tentative, long with strict selectivity. Long opportunities may be emerging within mid-cap industries showing sustained new-high creation and persistent positive A/D. Large-cap short setups remain tactical only, focused on overextended names if breadth stalls and volatility re-expands.

Global Read

Participation is broadening as advances outpaced declines across the final three sessions and new highs expanded. Leadership is rotating from narrow, index-heavy leadership toward more inclusive participation, evidenced by the surge in NYHGH and the decline in NYLOW. Volatility is compressing after a brief shock, supportive of risk-taking but vulnerable to abrupt reversals. NYSI’s upturn and NYAD’s late-week strength show no adverse divergence; NYAD’s earlier weakness was resolved higher while NYSI continued to firm. The five-day pattern signals early accumulation. By the five-day consistency rule, signals remain constructive but not fully confirmed.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is improving: 519.74 → 516.28 → 539.67 → 569.22 → 569.22. The rise and subsequent plateau indicate renewed demand with no immediate deterioration.

2. NYAD (Advance–Decline Line)

Participation strengthened late: -351, -1,560, +1,597, +679, +679. Three consecutive positive prints underline improving breadth, offsetting early-week weakness.

3. NYHGH (New 52-Week Highs)

Leadership is expanding: 181 → 110 → 250 → 302 → 302. Sustained readings above 300 suggest more industries are contributing to upside momentum.

4. NYLOW (New 52-Week Lows)

Downside pressure eased: 33 → 61 → 35 → 14 → 14. Persistent suppression of lows supports risk appetite and reduces downside tails.

5. Volatility Regime

VIX moved 15.86 → 20.09 → 16.90 → 15.64 → 15.64; RVX 20.23 → 23.83 → 21.88 → 21.29 → 21.29. The post-spike compression favors carry and trend continuation, but the recent shock underscores sensitivity to headline risk. A volatility re-acceleration would warrant tightening risk and favor only tactical shorts in overextended large caps.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.