Breadth Broadens, Volatility Contained: Early Mid-Cap Longs; Await 2–5 Day Confirmation

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-12

Executive Summary

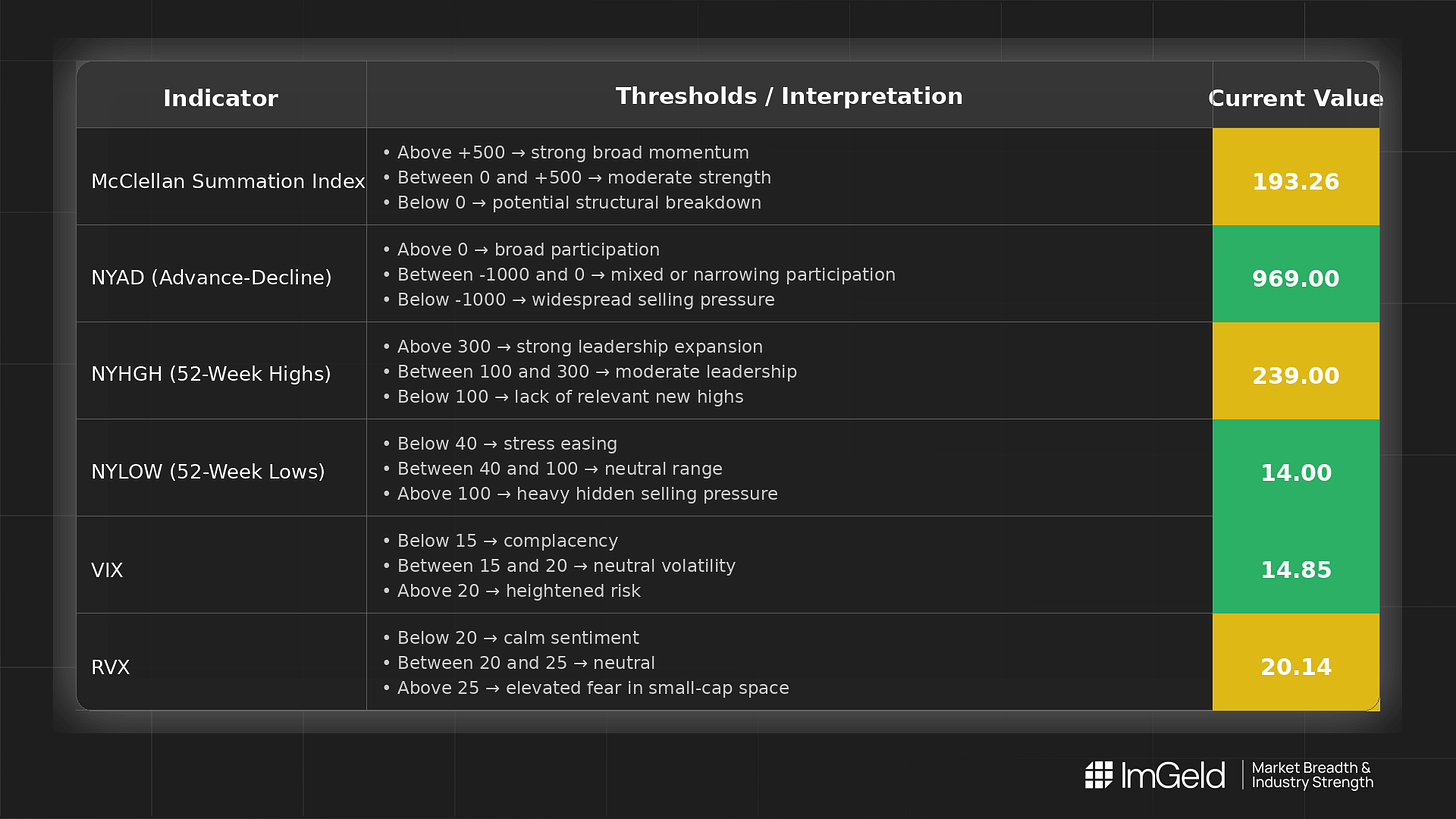

As of 2025-12-11, breadth registered a constructive single-day improvement, keeping the bias Tentative Long pending confirmation. NYSI (McClellan Summation Index) printed 193.26, supportive but not yet trend-defining. NYAD (Advance–Decline Line) rose to 969, signaling a positive participation day. VIX (CBOE Volatility Index) at 14.85 and RVX (Russell Volatility Index) at 20.14 indicate contained volatility.

Tactically, early long opportunities may be emerging within mid-cap industries showing rising new highs and steady participation. Short opportunities remain valid in large caps exhibiting narrowing leadership and negative breadth drift. Selectivity is high; look for 2 to 5 days of confirmation before adding risk.

Global Read

Participation appears to be broadening on the day, with leadership modestly expanding and volatility compressed. There is no meaningful divergence between NYSI and NYAD on this print. With only a single session of evidence, the five-day pattern signals early accumulation but remains tentative by the five-day consistency rule (1 day isolated = Tentative). Leadership is not yet overly concentrated; the advance appears inclusive enough to support a cautious pro-risk stance if follow-through develops and volatility stays contained.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is provisionally improving with a positive reading. However, the absence of a multi-session upslope argues for a tentative interpretation until a 2 to 5 day string confirms continuation.

2. NYAD (Advance–Decline Line)

Breadth strengthened on the day, reflecting broad participation. Sustained daily net advances over multiple sessions would upgrade the read from tentative to firmly constructive.

3. NYHGH (New 52-Week Highs)

At 239, leadership expansion is evident, consistent with constructive risk tone. Watch for continued elevation or a rising 5-day average to validate a durable upswing across leading industries.

4. NYLOW (New 52-Week Lows)

At 14, downside pressure is muted, indicating limited forced selling and healthy risk appetite. A continued suppression of lows would reinforce the pro-cyclical tilt in breadth.

5. Volatility Regime

VIX at 14.85 and RVX at 20.14 point to a benign, compressed regime. Contained volatility supports incremental risk-taking, but the lack of multi-day confirmation argues for measured deployments with defined risk controls until a persistent vol floor forms.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.