Breadth Broadens, Volatility Compresses—Favor Mid-Cap Breakouts, Fade Crowded Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-09

Executive Summary (as of 2026-01-10)

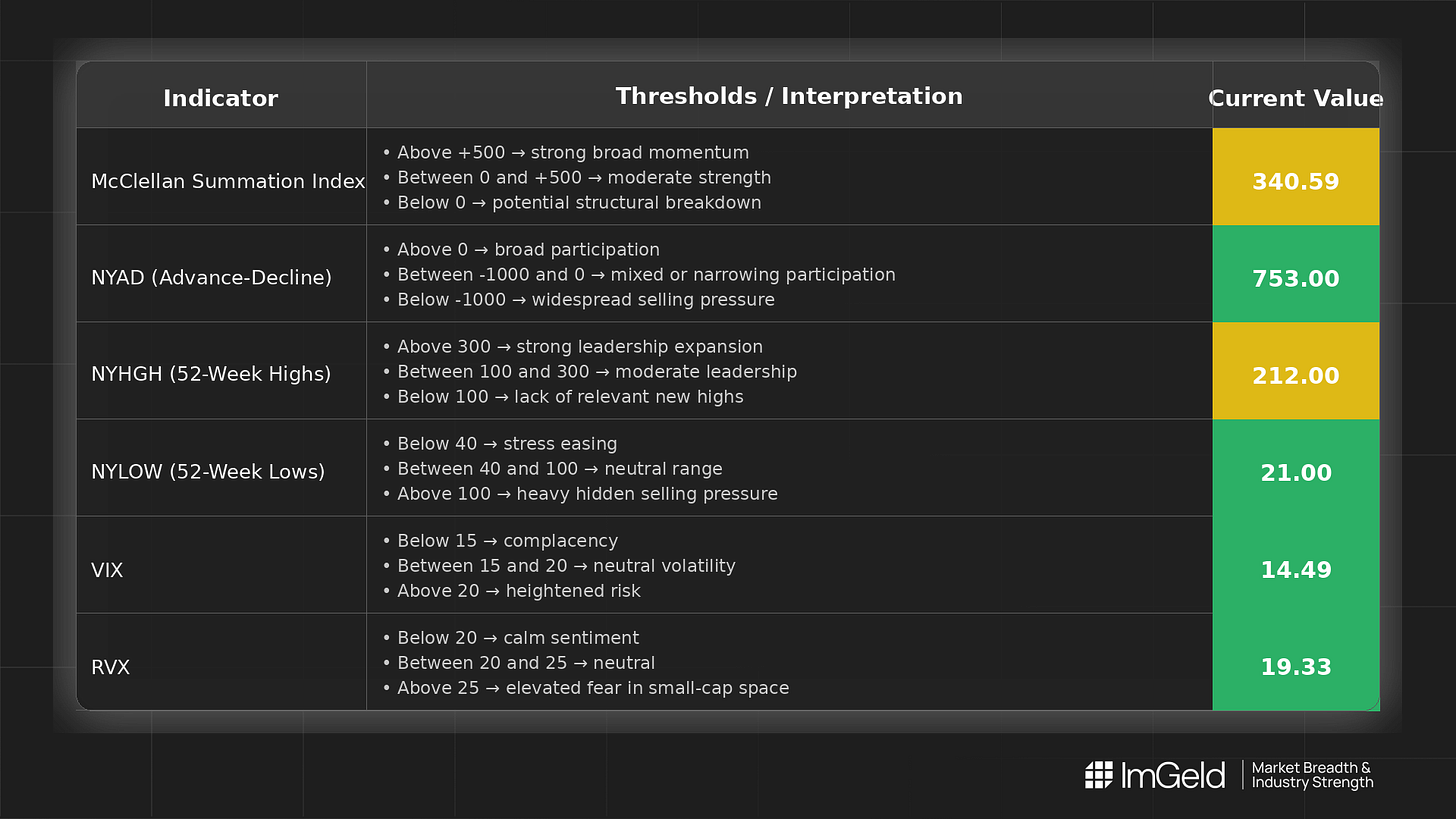

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) advanced for three days and then plateaued, signaling an improving intermediate structure with a short-term pause. NYAD (Advance–Decline Line) was mixed but net positive, with one sharp down day offset by multiple strong up days. Volatility tone eased as VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) compressed back toward recent lows.

Tactically, long opportunities are emerging selectively in mid-cap industries where new highs broaden and new lows contract. Short opportunities remain valid in crowded large-cap leadership that shows faltering momentum or weak breadth confirmation. Selectivity is high; chase only confirmed mid-cap breakouts and fade stretched large caps that fail to confirm on breadth.

Global Read

Participation is moderately broadening, with leadership starting to expand beyond the most crowded leaders. Volatility is compressing, supportive of breakouts but prone to abrupt reversals if breadth stumbles. A mild divergence exists: NYSI is firmly improving while NYAD had one isolated down day, suggesting participation remains tentative day to day. Applying the five-day consistency rule: NYSI improvement is Firmly; NYAD signal is Tentative; new highs expansion is Firmly; new lows contraction is Firmly; volatility compression is Firmly. The five-day pattern leans toward early accumulation with a late-week pause.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Three consecutive advances from 259.16 to 340.59 followed by a plateau indicate an improving intermediate trend with near-term consolidation.

2. NYAD (Advance–Decline Line)

Daily participation was volatile but net positive: strong advances on three sessions offset a single sharp decline. Breadth is strengthening, albeit with episodic setbacks.

3. NYHGH (New 52-Week Highs)

Recovery from 137 to 212 and holding suggests leadership expansion. This supports selective risk-on in mid-cap industries showing persistent relative strength.

4. NYLOW (New 52-Week Lows)

Decline from 41 to 21 and stabilization indicate easing downside pressure and improving risk appetite.

5. Volatility Regime

VIX moved from 14.90 to 15.45 then compressed to 14.49; RVX tracked similarly, ending at 19.33. The regime is low and compressing, favoring measured risk-taking but requiring tight risk controls given potential for volatility inflection.

Tactical Implications

- Long: Focus on mid-cap industries with rising participation and expanding new highs, such as building products, industrial machinery, specialty chemicals, and regional financials. Prioritize names breaking out on rising volume and improving breadth overlays.

- Short: Only in large caps where leadership appears overextended with waning breadth and momentum, particularly if rallies occur on shrinking advance–decline support.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.