Breadth Broadens, Volatility Compresses: Mid-Cap Longs Favored as Large-Cap Weakness Persists

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-02

Executive Summary Date: 2026-01-05

Over the last five sessions, NYSI (McClellan Summation Index) slipped and then stabilized, while NYAD (Advance–Decline Line) flipped from deeply negative to firmly positive for three consecutive sessions, signaling improving participation despite a lagging summation structure.

Volatility eased and compressed, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both drifting lower and holding steady at subdued levels.

Tactically, selective long opportunities appear to be emerging in mid-cap industries where new highs are expanding and breadth is holding. Short setups remain primarily in large caps exhibiting deteriorating breadth and persistent new lows; selectivity and tight risk management are required given low volatility and a NYSI–NYAD divergence.

Global Read

Participation broadened in the last three sessions as NYAD turned and held positive, and NYHGH outpaced NYLOW. Leadership is rotating and incrementally widening beyond prior narrow leaders, but it is not decisive because NYLOW ticked up and NYSI declined before flattening. Volatility is compressing, which supports trend continuity but raises the risk of abrupt moves on any shock. There is a clear divergence: NYAD is improving while NYSI has not yet confirmed. By the five-day consistency rule, breadth improvement is firmly present short term (three straight days), but structural confirmation remains tentative. The pattern points to early accumulation rather than a mature continuation or an exhaustion peak.

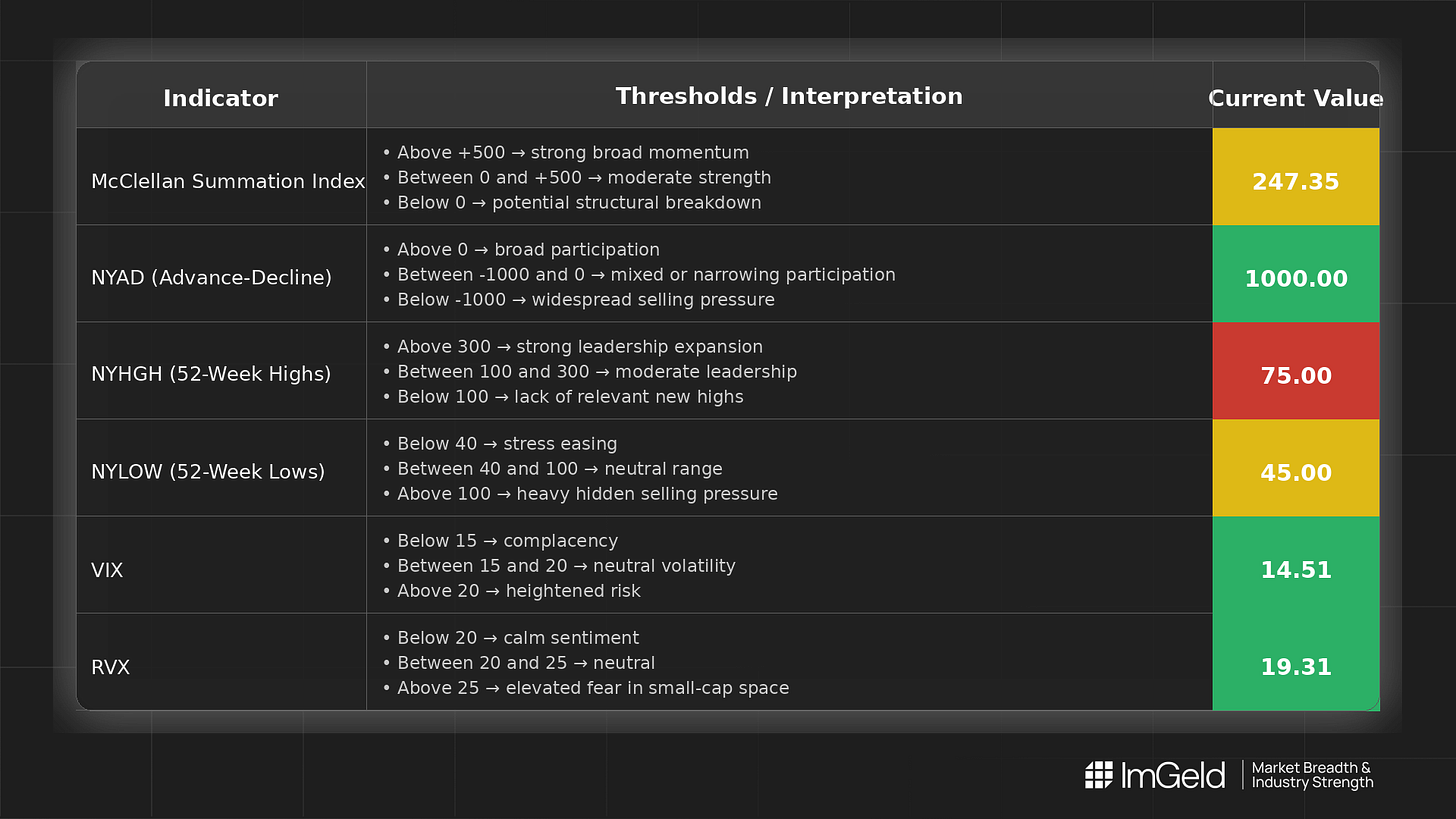

Indicator Breakdown

NYSI (McClellan Summation Index)

Declined from 254.24 to 247.35 on the third session, then plateaued. Structure is weakening with a nascent base; confirmation requires renewed upward thrust.

NYAD (Advance–Decline Line)

Two negative sessions followed by three consistent positive readings (+1000). Daily participation is strengthening firmly in the short term.

NYHGH (New 52-Week Highs)

Rose from 34 to 75 and held for three days. Leadership expansion is firm, pointing to improving risk appetite.

NYLOW (New 52-Week Lows)

Increased from 40 to 45 and stayed elevated. Downside pressure is not fully resolved; mixed undercurrents persist despite improving highs.

Volatility Regime

VIX eased from 14.95 to 14.51 and RVX from 19.43 to 19.31, then both stabilized. Compression favors carry and trending conditions but can mask latent gap risk; sizing and stop discipline remain important.

Tactical Takeaways

Longs: Favor mid-cap industries showing sustained breadth improvement and expanding highs, such as building products, machinery, regional banks, specialty retail, application software, and semiconductor equipment. Focus on names with persistent relative strength and improving advance–decline profiles.

Shorts: Concentrate on large caps in industries where breadth remains weak and new lows persist, notably defensive areas like utilities and household products. Prioritize breakdowns into strength with tight risk controls.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.