Breadth Broadens, Volatility Compresses: Accumulate Mid-Caps, Fade Extended Large-Cap Leaders

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-26

Executive Summary (as of 2025-12-25)

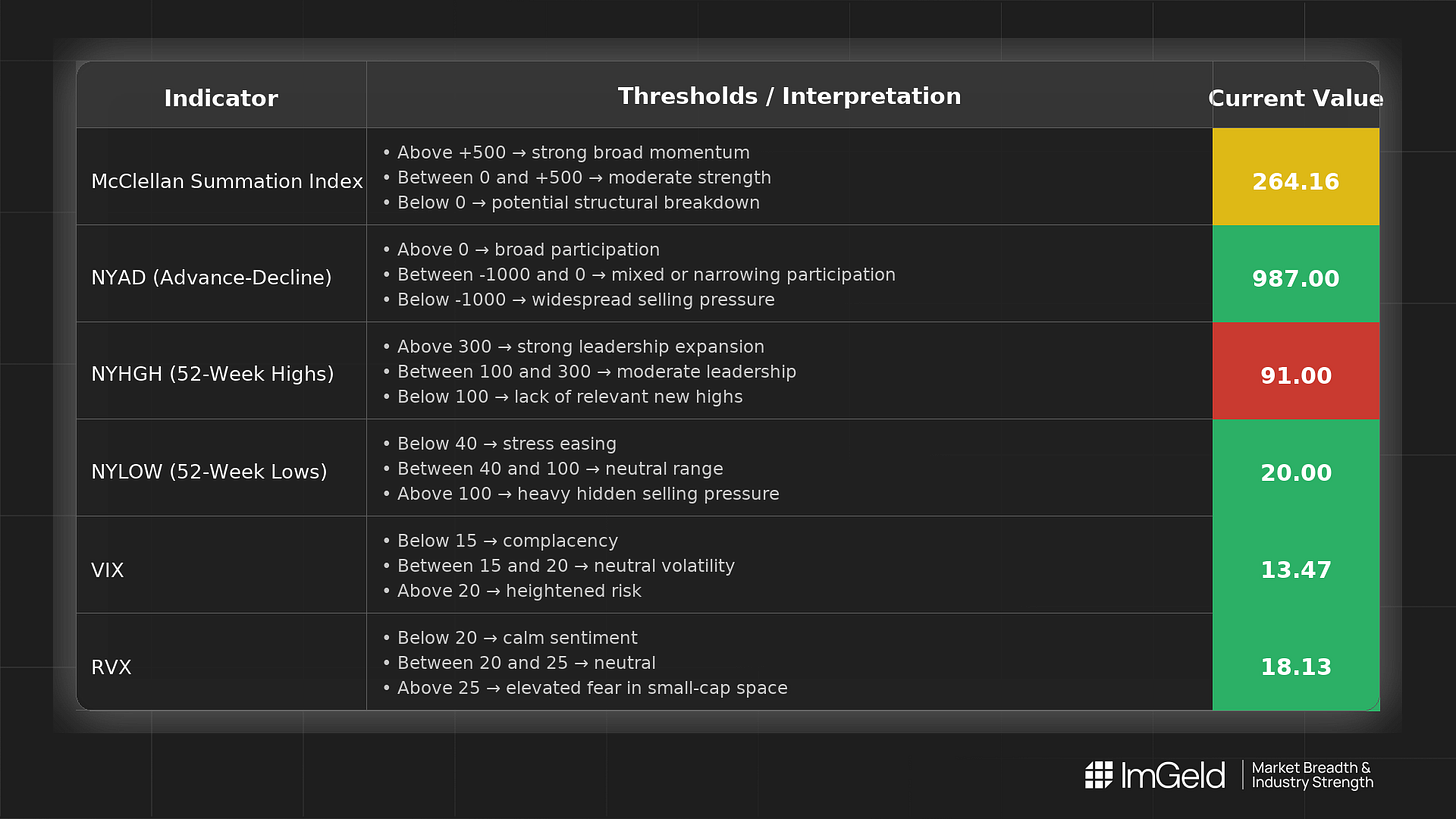

- Breadth: NYSI (McClellan Summation Index) advanced for four sessions and held steady, signaling improving internal momentum. NYAD (Advance–Decline Line) delivered three strong positive days with one notable negative print, indicating breadth is strengthening but uneven.

- Volatility: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) compressed steadily, supportive for risk but raising near-term reversal risk if catalysts appear.

- Tactical: Tentative long bias with a fully long posture remains justified, but selectivity is essential. Long opportunities are emerging in mid-cap industries showing relative strength and earnings revision support, such as industrial automation, building products, application software, and specialty finance. Short setups remain valid in crowded large-cap leadership where momentum is extended, notably in large-cap consumer internet platforms and large-cap chip designers.

Global Read

Participation is tentatively broadening as net advances outweighed declines on most days and NYLOW (New 52-Week Lows) contracted. Leadership is firmly narrowing given the downtrend in NYHGH (New 52-Week Highs) over the last three sessions, implying gains are less expansive. Volatility is firmly compressing across VIX and RVX, favoring trend continuation but susceptible to sharp mean reversion. A mild divergence persists: NYSI is rising while NYAD was choppy and NYHGH faded, pointing to improving structure without decisive leadership expansion. By the five-day consistency rule: participation broadening remains, leadership narrowing is firmly in place, and volatility compression is firmly established. The pattern suggests early accumulation with selective participation rather than an all-clear breakout.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Improving. Risen from 218.77 to 264.16 over four days, then plateaued, indicating constructive intermediate momentum and underlying accumulation.

2. NYAD (Advance–Decline Line)

Strengthening but uneven. Daily prints: +699, +721, -438, +987, unchanged. The strong rebound after the mid-week dip supports a tentative broadening thesis.

3. NYHGH (New 52-Week Highs)

Leadership expansion faded. After a pop to 143, highs slipped to 91 and held, signaling concentration in winners and fewer breakouts.

4. NYLOW (New 52-Week Lows)

Downside pressure eased. Lows fell from 47 to 20, consistent with improving risk appetite and reduced forced selling.

5. Volatility Regime

VIX fell from 16.87 to 13.47 and RVX from 20.49 to 18.13, a firm compression. This backdrop supports carry and breakout attempts in mid-caps, while cautioning against complacency and guarding for vol re-expansion.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.