Breadth Broadens, Volatility Compresses: Risk Appetite Returns—Select Long Mid-Cap Breakouts

ImGeld Market Breadth Update Based On Last Five Closing Days Till Date : 2025-11-26

Executive Summary

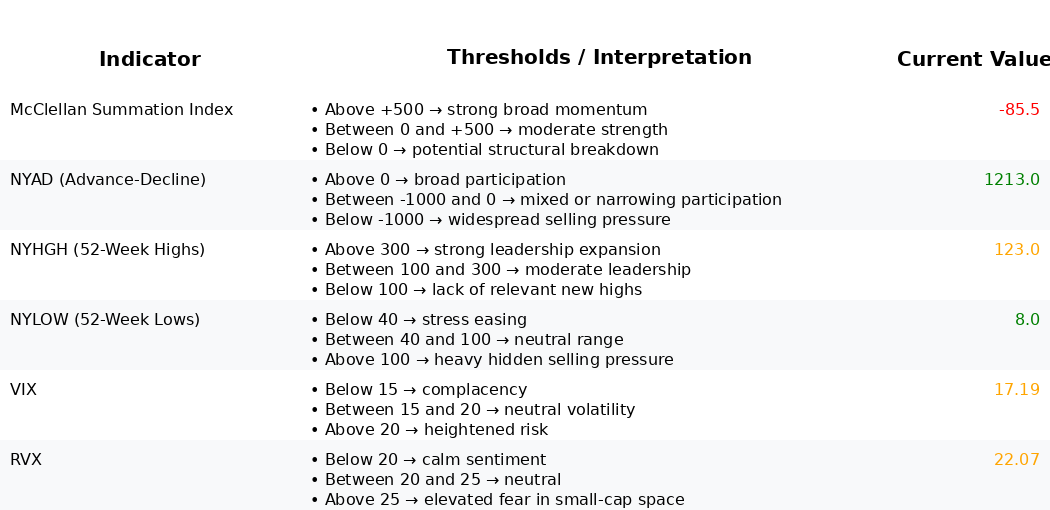

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) remains negative but turned higher in the last two days. NYAD (Advance–Decline Line) printed four consecutive positive sessions, signaling expanding participation. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both compressed steadily to recent lows. New highs accelerated and new lows collapsed, indicating risk appetite returning.

Tactical take: with breadth firming and volatility compressing, long opportunities are emerging selectively in mid-cap industries showing expanding leadership and clean breakout structures. Short setups remain valid in large-cap laggards where breadth is deteriorating or rallies are failing at resistance. Selectivity remains high given NYSI still below zero.

Global Read

Participation is firmly broadening over the last four sessions as advances outpaced declines and new highs surged. Leadership is rotating away from defensive profiles toward risk-on groups, with leadership breadth becoming less concentrated as NYHGH expanded materially. Volatility is firmly compressing in both large-cap and Russell volatility gauges, supportive of trend resumption and breakout validation. A mild divergence persists: NYSI remains negative while NYAD strengthened, consistent with early accumulation where shorter-term breadth improves ahead of the longer oscillator. The five-day pattern signals early accumulation rather than continuation or exhaustion.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure improved: -119.32 to -144.89 to -153.03 trough, then rising to -128.47 and -85.46. Momentum is turning up but remains below zero, cautioning that the upturn is tentative until sustained positives.

2. NYAD (Advance–Decline Line)

Breadth strengthened: after a -1542 downtick, four straight positives (1690, 735, 1663, 1213). This reflects broad participation consistent with accumulation.

3. NYHGH (New 52-Week Highs)

Leadership expansion: 44, 37, 47, 101, 123. The jump above 100 on the last two sessions indicates improving breakout quality across multiple industries.

4. NYLOW (New 52-Week Lows)

Downside pressure receded firmly: 152, 99, 39, 22, 8. Compressed new lows align with waning forced selling and healthier risk appetite.

5. Volatility Regime

VIX declined from 26.42 to 17.19 and RVX from 29.59 to 22.07 over five sessions. Firm compression supports constructive risk-taking, favors continuation of breadth improvement, and increases the importance of disciplined stop placement given potential for volatility re-expansion.

Tactical Implications

- Long: prioritize mid-cap industries with rising new-high participation and positive breadth thrusts, such as application software, semiconductor equipment, industrial machinery, building products, and regional banks, focusing on names with constructive bases and volume confirmation.

- Short: large-cap laggards where breadth remains weak or rallies fail, including defensively positioned utilities, select large-cap pharmaceuticals, and mega-cap interactive media with deteriorating advance–decline profiles.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.