Breadth Broadens, NYSI Turns Up: Early Accumulation Favors Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-07

Executive Summary Date: 2026-01-08

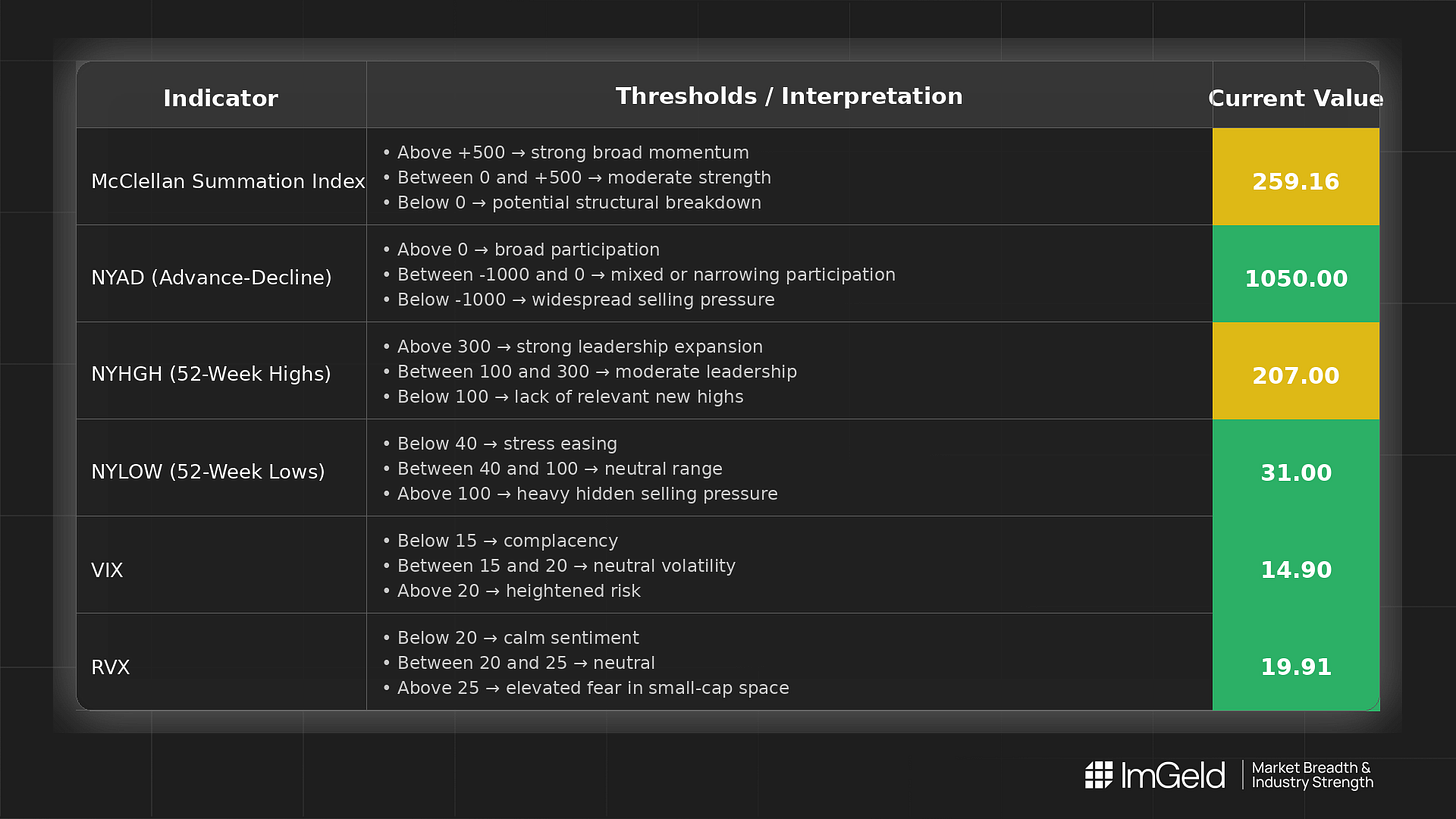

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) inflected higher into today after a mid-period dip. NYAD (Advance–Decline Line) turned positive and held for three consecutive prints, indicating firmer participation. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) remain in a low regime with a modest uptick today, keeping the volatility backdrop constructive but requiring vigilance.

Tactically, selective mid-cap long opportunities are emerging in industries showing persistent advances and rising new highs. Large-cap shorts remain valid only where leadership is crowded, and momentum is stalling.

Global Read

Participation is firmly broadening over the last three sessions as advances outpaced declines consistently. Leadership is rotating away from narrow prior winners toward a wider list, evidenced by a surge in new highs and easing new lows. Volatility compressed earlier in the window and ticked up slightly today, not yet signaling stress. A brief divergence appeared when NYSI softened while NYAD improved, but it has now resolved with NYSI turning up. By the five-day consistency rule: participation broadening is firmly in place, the NYSI turn is tentative, and the pattern signals early accumulation rather than exhaustion.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure improved: 254.24 to 247.35 mid-period, then up to 259.16 today. The upward inflection is constructive but, with only one session of decisive improvement, it remains tentative.

2. NYAD (Advance–Decline Line)

Breadth strengthened: from deeply negative to three consecutive positive readings (1000, 1000, 1050). This indicates firmer, broad-based buying pressure.

3. NYHGH (New 52-Week Highs)

Leadership expansion is robust: 34 to 207. Breakouts are widening, supportive of a risk-on tilt within selective mid-cap industries.

4. NYLOW (New 52-Week Lows)

Downside pressure eased: 40–45 earlier, improving to 31 today. Risk appetite is improving as selling dries up.

5. Volatility Regime

VIX held low (14.95 to 14.51, then 14.90), while RVX edged up (19.43 to 19.91). The regime remains accommodating for equity follow-through, but the uptick argues for risk controls and selectivity.

Tactical Take

- Long: Focus on mid-cap names within industries displaying sustained advances and expanding new-high lists. Favor setups with confirmation from improving NYAD and a rising NYSI.

- Short: Only consider large-cap exposures where leadership is over-owned and momentum is fading, particularly if volatility expands or breadth stalls.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.