Breadth Broadens, New Highs Expand; Selective Mid-Cap Longs, Defensives at Risk

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-14

Executive Summary

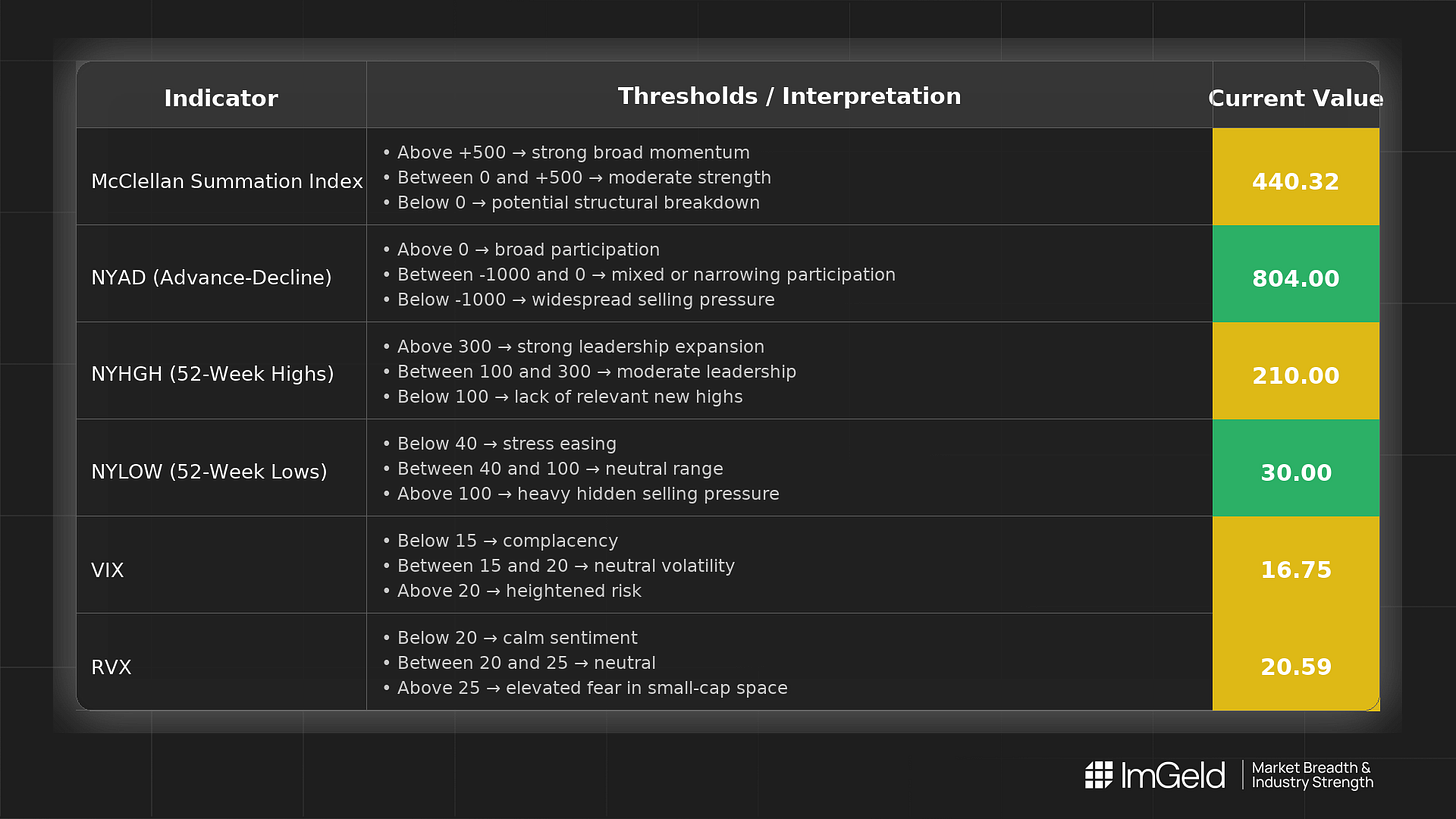

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) advanced from 287.82 to 402.56, while NYAD (Advance-Decline Line) printed four positive days out of five but decelerated into +189 today. Leadership expanded as NYHGH (NYSE New 52-Week Highs) rose from 137 to 237 and NYLOW (NYSE New 52-Week Lows) stayed suppressed, ticking up only to 28. Volatility stayed contained with a late uptick in VIX (CBOE Volatility Index) to 15.98 and RVX (Russell Volatility Index) to 20.22.

Tactically, long opportunities are emerging selectively in mid-cap industries showing persistent new-high expansion and constructive participation. Short opportunities remain valid in large-cap defensives where distribution persists, particularly if the late volatility uptick extends.

Global Read

Participation is firmly broadening: rising NYSI, four positive NYAD prints, higher new highs, and contained new lows. Leadership is broadening rather than concentrating, with new-high expansion suggesting rotation into a wider set of winners. Volatility remains low but is beginning to expand at the margin, warranting added selectivity. A mild divergence appears as NYSI continues to trend up while NYAD loses momentum on the latest day. The five-day pattern signals early accumulation with a tentative bias, contingent on whether volatility expansion fades or accelerates.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure is improving. The index climbed consistently to 402.56, indicating intermediate-term breadth thrust and supportive underpinnings for further upside if participation holds.

NYAD (Advance-Decline Line) Daily participation strengthened mid-period (+1042, +753, +753) but faded into +189, implying buyers remain in control yet are becoming more selective. Watch for confirmation via a renewed push higher or a rollover.

NYHGH (NYSE New 52-Week Highs) Leadership expansion is intact, rising from 137 to 237. This supports the case for continued accumulation in outperforming mid-cap industries.

NYLOW (NYSE New 52-Week Lows) Downside pressure remains muted, with lows compressed in the low 20s and a modest uptick to 28. Risk appetite is still healthy provided lows do not trend higher.

Volatility Regime VIX hovered in the mid-teens before a late rise to 15.98; RVX mirrored the move to 20.22. The regime remains low, but the late-session expansion argues for disciplined entries and risk controls.

Tactical Take

Long: Favor selective mid-cap industries with persistent breadth and leadership, such as software, semiconductors, and capital goods where new-high participation is firm.

Short: Large-cap defensives remain candidates where relative weakness and distribution persist, including consumer staples, utilities, and legacy telecom, particularly if volatility continues to firm.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.