Breadth Broadens, Leadership Narrows; Low Vol Favors Mid-Cap Longs, Underweight Defensives

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-26

Executive Summary

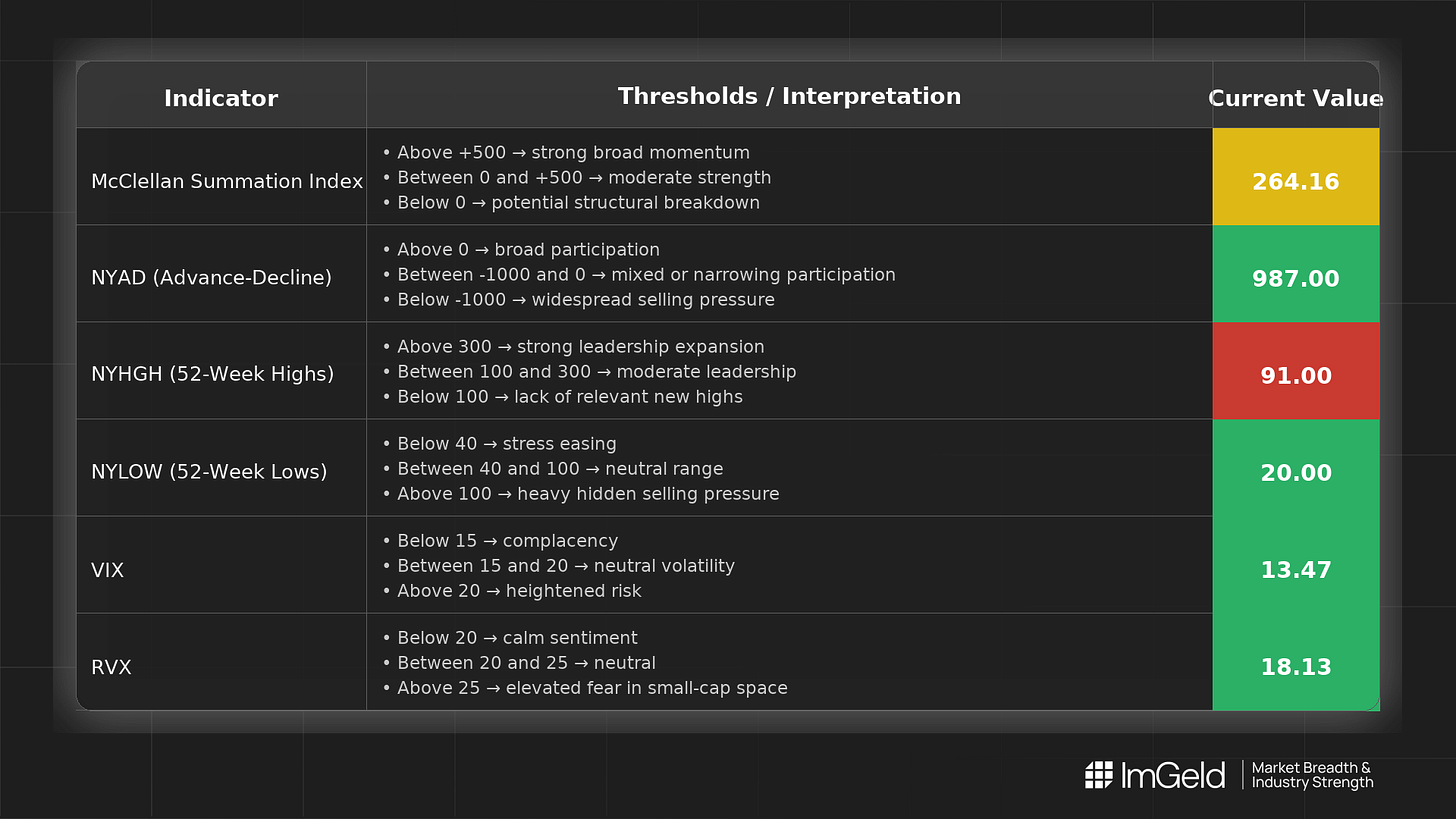

As of 2025-12-26, breadth is improving while leadership remains restrained. NYSI (McClellan Summation Index) advanced across the last five sessions, and NYAD (Advance–Decline Line) produced four positive prints out of five. Volatility compressed, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) drifting lower. NYHGH (New 52-Week Highs) declined, while NYLOW (New 52-Week Lows) fell, signaling accumulation without robust breakout leadership. Tactical bias remains tentative long, with selectivity paramount. Long opportunities are emerging in mid-cap industries showing improving participation, notably industrial machinery, building products, specialty chemicals, and regional banks. On the short side, opportunities remain valid in large-cap defensive industries where momentum is fading, such as consumer staples and utilities.

Global Read

Participation is broadening, firmly by the five-day consistency rule, as NYAD stayed net positive and NYSI trended higher. Leadership is becoming more concentrated, with new highs contracting, suggesting rotation toward laggards and mean reversion rather than expansion in breakout leaders. Volatility is firmly compressing. There is no material divergence between NYSI and NYAD, but there is a notable divergence between strengthening breadth and shrinking new-highs. The five-day pattern indicates early accumulation rather than exhaustion, with continuation potential contingent on renewed leadership expansion.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is improving. The index rose from 239.09 to 264.16 and then held steady into the holiday prints, indicating persistent net accumulation pressure.

2. NYAD (Advance–Decline Line)

Daily participation strengthened: +721, -438, then three consecutive strong positives (+987 repeated across holiday sessions). The sequence signals broad support with one mid-period pullback.

3. NYHGH (New 52-Week Highs)

Leadership expansion weakened, falling from 143 to 91 and stabilizing there. Breakout quality is not yet confirming the breadth upswing.

4. NYLOW (New 52-Week Lows)

Downside pressure receded, easing from low 40s to 20 and staying subdued. Risk appetite is improving as forced selling diminishes.

5. Volatility Regime

VIX compressed from 14.08 to 13.47 and RVX from 18.69 to 18.13. The decline supports a constructive backdrop for mid-cap momentum and mean-reversion setups, while warning that any shock could catalyze a sharp reversion from low vol.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.

The divergence between broadening NYSI/NYAD and contracting NYHGH is textbook rotation into laggards rather than breakout expansion. I've traded similr setups where low vol environments favor mean reversion over momentum, and the mid-cap thesis here makes sense given the compressed VIX. Watching if new highs stay supressed past 5 more sessions typically confirms whether this is healthy rotation or distribution.