Breadth Breaks Down: NYSI Goes Negative, Volatility Spikes—Favor Tactical Short Setups

IMGELD Market Breadth Update: 2025-11-21 15:37:30

Executive Summary

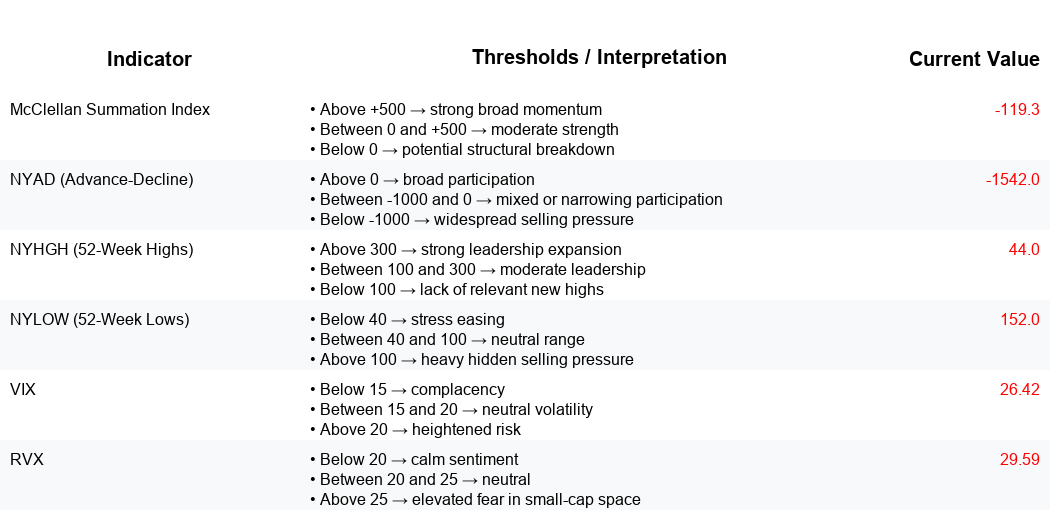

Breadth weakened materially over the past five sessions. NYSI (McClellan Summation Index) fell steadily from 81.88 to -119.32, breaking below zero and accelerating lower. NYAD (Advance–Decline Line) printed four negative days out of five, confirming deteriorating participation. Volatility expanded, with VIX (CBOE Volatility Index) rising to 26.42 and RVX (Russell Volatility Index) to 29.59. NYLOWs stayed elevated and outpaced NYHGHs despite a one-day uptick in highs.

Tactical stance: Tentative short. Short setups remain valid, particularly in large caps showing leadership fatigue and in cyclically exposed industries. Any long risk should be highly selective and limited to mid-cap names within defensive or countercyclical industries exhibiting relative strength on pullbacks.

Global Read

Participation is narrowing and leadership is becoming more concentrated. Volatility is expanding, not compressing. NYSI and NYAD are aligned to the downside; the late-week bounce in NYHGH is not confirmed by advances, suggesting dispersion rather than sustainable leadership. By the five-day consistency rule, breadth deterioration is Firmly in place, while the isolated positive AD day and the modest uptick in highs argue for maintaining a tentative tone to avoid chasing breakdowns into short-term oversold bounces. The pattern favors continuation lower rather than early accumulation; exhaustion signs are limited.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is declining each session (81.88 to -119.32). The decisive cross below zero on 11/18 and continued downside into 11/20 indicate building negative momentum.

2. NYAD (Advance–Decline Line)

Daily participation is weakening: -451, -1824, +184, -650, -1542. The lone positive day was insufficient to alter the trend; net breadth remains negative.

3. NYHGH (New 52-Week Highs)

Leadership expansion is muted. Highs drifted down into 11/19 and rebounded to 44 on 11/20, but remain modest and not corroborated by AD strength.

4. NYLOW (New 52-Week Lows)

Downside pressure is elevated (121–168 range) and consistently above highs, signaling poor risk appetite and ongoing distribution.

5. Volatility Regime

VIX and RVX stair-stepped higher throughout the week, signaling expanding risk premia and tighter financial conditions. Tactically, favor disciplined short setups, faster trade horizons, and only selective long exposure in mid-cap defensives (e.g., regulated utilities, property & casualty insurance, gold miners) showing relative strength. Large-cap shorts remain appropriate where leadership is breaking down in rate-sensitive or high-duration industries.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.