Big Tech Is Building the Largest Cash incinerator in Corporate History

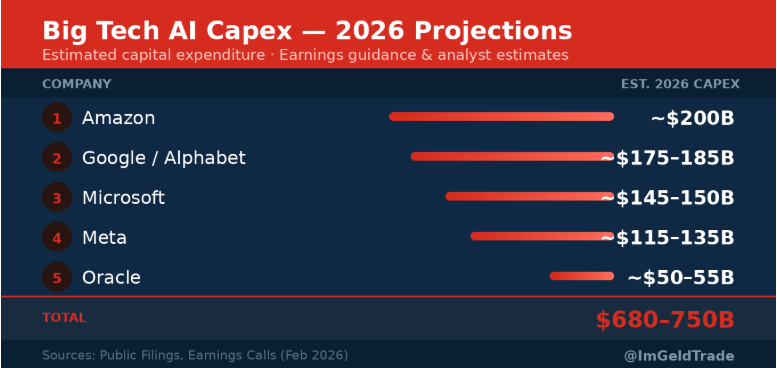

~$700 Billion in AI Capex Projected for 2026 — What It Means for Your Portfolio

Big Tech is about to spend more on AI infrastructure than the GDP of most countries. From ~$270B in 2024, to ~$450B in 2025, to a projected **$700B+ in 2026**. That’s ~75% of the entire U.S. defense budget. In a single year. By five companies.

This isn’t a tech story. It’s a capital allocation event reshaping the companies most portfolios are built around.

## The Risks Nobody Wants to Talk About

**Uncertain ROI.** AI services revenue across hyperscalers is ~$25–30B annually. Capex is running 20–30x those revenues. Hardware depreciates in 2–3 years (vs. 5–6 on the books). If enterprise adoption doesn’t accelerate, massive write-downs are coming.

**Overexpansion.** Everyone is hoarding compute. Over $1 trillion in market cap was already wiped in sell-offs after high-capex guidance. Amazon dropped 5–10% on the $200B announcement alone.

**Cash flow pressure.** Amazon is projected at **-$17 to -$28B in free cash flow** for 2026. Record debt issuance ($100B+ in 2025). And 150K–220K layoffs estimated across MAG7 in two years — funding servers over people.

**Circular dependency.** ~45% of Microsoft’s cloud backlog comes from OpenAI — not expected to be profitable until 2029+. Much of “AI revenue” is hyperscalers selling compute to each other. Limited flow to the productive economy so far.

If AI monetizes explosively, it’s transformative. If not — significant valuation reset ahead.

## The Market Is Already Differentiating

The AI capex wave is **not** hitting all of Tech equally. Cloud infrastructure, semiconductors, and data center REITs are diverging sharply from consumer tech and software.

Stocks with the highest capex guidance got hit hardest post-earnings. Capital-disciplined names held up better. The market is no longer treating “Big Tech” as one trade.

**Knowing which industries benefit vs. which absorb the cost — that’s the edge.**

At ImGeld, we track **~50 US industries daily** using momentum and fundamental data.

Market → Industry → Stocks.

Right now, the divergence within Tech alone is remarkable.